Concept 1: Start Early And Harness The Power Of Compounding Interest

I was 21 years old when I joined the fire service and despite recently graduating with a degree in economics from UC Davis, was incredibly naive to how I was ever going to retire comfortably. I was the last academy to have the benefit of a pension, and I thought that was enough. Was I wrong! It was early on in my probationary year that I met Firefighter Benson Perez.

A Renaissance Man of sorts, there was nothing Benson couldn’t handle and the day I worked with him, he took me under his wing. In addition to teaching me about firefighting strategy and tactics that made my head spin, I watched and helped him concoct a magical elixir of meat and vegetables. He used vegetables I had never even heard of (what the hell is a leek anyways?). It was a great day of learning and laughing and eating some gourmet meals. One of the funniest and most valuable parts of the day working with him was in the afternoon when he pulled me into the station’s office. In a sort of impromptu ceremony he barked out, “Young Bixler! Raise your right hand and repeat after me.” Perplexed, I raised my hand and followed along.

“Rule 1: 401k! Rule 2: Deferred Comp! and Rule 3: Don’t date anyone on the job…you may mess that one up,” he cracked a smile, knowing that my father had recently remarried to a wonderful woman who just so happened to be a fellow firefighter. After repeating Benson’s Three Rules, he then proceeded to guide me through the process of signing up for my additional retirement accounts. I wasn’t making much money at the time, but I made the conscious decision to set aside a small amount that automatically got pulled from my biweekly paycheck. I know I am not alone in being one of Firefighter Perez’s students. Many firefighters I talk to about how they got squared away in retirement planning have similar stories of Benson’s Three Rules. It wasn’t until the last few years that I truly have begun to see the importance of what he guided me to. The magic of compounding interest has worked, and I have begun to see the WHY in his rules. Benson has since retired, but when I see him again, I want to buy him one of his favorite IPAs and thank him wholeheartedly for setting me on the right path. Until then, I think it is incredibly important to teach our newest members about the concepts of retirement planning early.

SEE Your Money Working For You

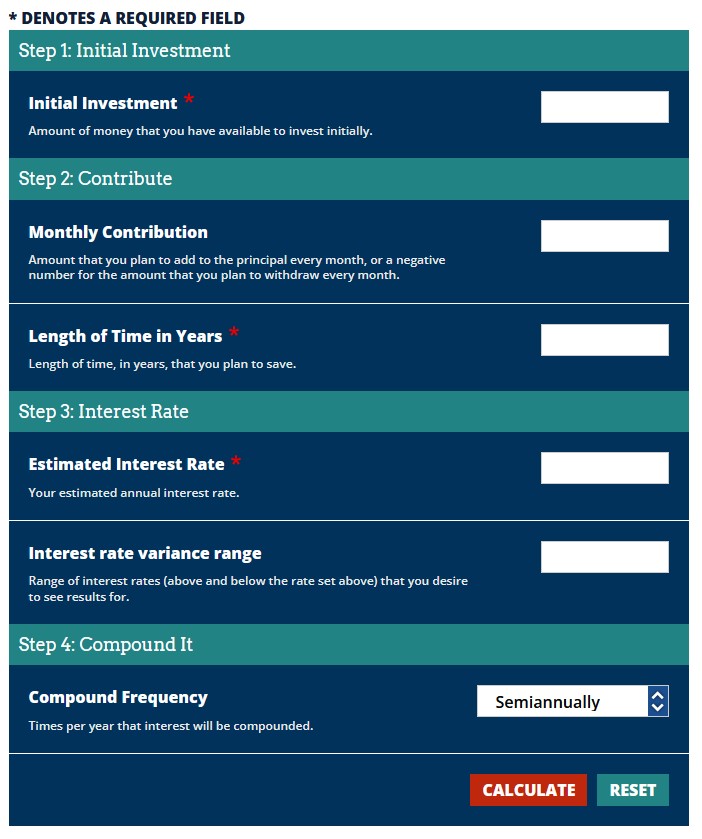

This doesn’t follow the traditional approach to retirement planning. Typically, you would calculate your expenses and then figure out HOW to achieve a retirement account that will support those needs, but money talks. A brand new firefighter fresh out of the academy wants to be learning about firefighting tactics and department expectations and have little interest in calculating future expenditures on the house and family they might not have yet. Break out the compound interest calculator to at least put the importance of investing early in their head. Here is a link to my favorite one.

https://www.investor.gov/financial-tools-calculators/calculators/compound-interest-calculator

Have them play around with the numbers

For simplicity sake in this drill, I like to use:

Initial Investment: 0 -You can start with more, but 0 is starting from scratch.

Monthly Contribution: Whatever they feel is a comfortable amount to invest per month. $100 a month seems doable for most new firefighters.

Length of Time: 30. Investing over the standard 30 year career of a firefighter.

Estimate Interest Rate: Investing in different investments yields different rates, but for the purpose of this drill, 10% is a nice achievable number that I feel gets the point across.

Interest rate variance rate: 0. You could get more technical, accounting for changes in the market over time, but for the sake of this drill, to illustrate the power of compounding interest, 0 is completely acceptable.

Compound frequency: Semiannually. This reflects most retirement savings accounts that receive quarterly dividend payments to reinvest. You can easily change the parameters. Really the point of the drill is to highlight compounding interest.

Put It All Together

Start by these initial parameters. $100 over 30 years at 10% interest will yield you a nice lump sum of $212,150.23 with only having to pay $36,000. Change the time frame to 15 years to show how waiting to invest will cost you in the long term. Change the monthly contribution to more, or less. Up your interest rates. Play around with it. The bottom line in this drill is to show the magic of compounding interest. There are so many different investment types, each with their own risk profiles and respective returns. The easiest way to grow wealth for most people will be to contribute to their 401k or deferred compensation accounts in a target retirement date index fund. At this point, the quick five minute drill is complete. The takeaway: invest early, invest often, and you really don’t need to invest much to get you where you need to be for a comfortable retirement. This blog will seek to answer more questions about how to invest, how to reduce risk, and how to plan for retirement, but all of this is impossible without a quick respect for the magic of compounding interest.