Constructing Line Without A Safe Anchor Point….Diddling in the Middle

Vegetation Fire Initial Attack….A massive inferno vaporizes the waist high shrubs outside your window as you pull up to scene. Homeowners scream for you to save their homes and everyone on the block threatened by the fire points to their driveway. Ash rains from the sky. In these brief moments of chaos, it’s time to breath, organize and then set a plan in motion. Ask yourself, are you charging into the unburned brush head on into the fire, or are you picking a clear line in the dirt to make a safe and calculated attack?

In the first post since coming clean on my faults as a trader, I figured it would be beneficial…no therapeutic even…to write on a common mistake I make while trading. Perhaps it will reinforce better habits in the long run. It’s almost infuriating that I do so, because the firefighting equivalent of doing so could easily get myself or my crew killed. It is killing my trading performance. In this article, I will discuss NWCG Watch Out Situation #8 and its application towards better trading.

Watchout #8: Constructing line without safe anchor point.

Anchor Points

In the wildland arena of firefighting, firefighters deal with an almost incomprehensible force of physics. Wildfires, driven by terrain, weather, and various fuel types, can create situations that even the most prepared force can succumb to. When fuel, weather and topography are in alignment, whole towns can be wiped off the face of the earth. We saw this in 2021 during the Dixie Fire, when the small Northern California town of Greenville was mostly destroyed. Whether tackling one of the States largest wildfires or just your small homeless encampment bon fire deep in an overgrown river valley, it’s important to remember the principle of having a good anchor before you commit to extinguishment. Anchors or anchor points are just simply areas where you would not reasonably expect a fire to cross given conditions. To simplify, if you exclude wind driven embers for a second, wildfires burning across the ground will not burn where there is no fuel. It’s simple…there’s nothing to burn and the fire should run out of momentum and even stop next to those points.

Depending on the size of the fire, we will use trails, drainage ditches, rivers, highways, or even the area the fire has already burned (the black), etc. as anchor points. We use these points to operate from as a reasonable safe point to start working on the active flanks of the fire. Ideally, the fire has moved to this point and has stopped burning. We work from a safe location to pick up the flanks of the fire and knock it down for good. Charging through unburned vegetation towards a fire is incredibly dangerous because any shift in wind direction can have the fire burn back onto you. This can be especially bad if you have terrain working against you. Having to run uphill through unburned fuel in order to get back to safety is not a recipe for success. We always do our best to work from an anchor point when we engage in fighting vegetation fires.

Anchor points are also a great line in the sand so to speak for anyone on the fire line to judge whether or not operations are proceeding safely. If a fire jumps over an anchor point, or across containment lines, we usually do a quick revaluation of whether or not to continue with the given assignment. Sometimes, we can commit additional resources to bring the fire in control and continue. A lot of times, it makes more sense to cut our loss in area burned, find the next anchor point and reengage the fire there.

Back to Candlesticks: Support and Resistance

We can and should find anchor points in the investing world. These are known as support and resistance lines or zones. They are areas on our charts where buyers and sellers clash in an epic battle to determine where the price will be going next. If we can sift through the noise and interpret the data, we can find anchor points that we can use to put on higher probability trades that increase our chances for success. These anchor points can come in the form of lines and zones. If a stock bounces upwards from these areas, it is know as SUPPORT. It means sellers loose steam and buyers take control and drive the price of a stock up. If the share price declines from that area, it is known as RESISTANCE and it means sellers are in control.

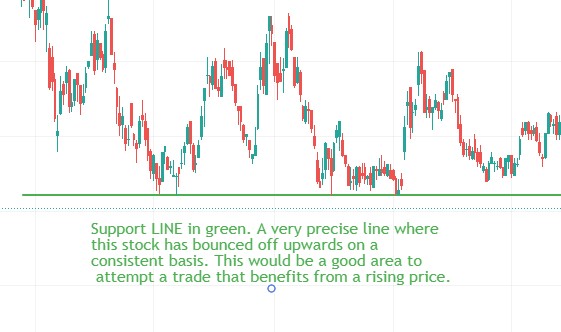

A line is an area where a stock price bounces off of in a very precise manner, sometimes almost down to the cent level. This would be the equivalent of fighting a fire from 8 lanes of an interstate highway. You have a very high degree of conviction that the stock price will change course almost immediately after reaching that point, much like you would not anticipate the fire blowing over a major highway. You can be very precise at picking when you want to enter a trade, and where you want to cut your losses. In a simplified sense (there are a lot of other factors in play when putting on a trade), in the example below, I would buy a stock or call option when the stock is at the green line. What this does is allow me to deploy my resources (capital or investment dollars) at a safer location than the middle of the trading range, where there is a higher degree of uncertainty as to where the stock price will go. I would then set my stoploss or bailout point below the line. If the stock price dips below that line, my thesis of what this stock is doing was likely wrong. I will sell at a small loss before it becomes a catastrophic loss.

A zone, is similar to a line, but it isn’t as clear. As firefighters, we know this well when fighting a wildfire. We may use a hiking trail as an anchor point. In some areas, the vegetation almost touches on both sides of the trail. In other areas, we have a clear cut path that provides us a more comfortable situation. It is not perfect, but it is better than fighting fire from unburned vegetation. Zones require a bit more skill to trade, but the concept is similar. Using the same stock example, the upper part of this trading range is more like a zone. You will have to be more flexible when entering a trade and more liberal in where to set your bail out point of stoploss.

Failing or Breaking Through

When a stock price challenges a support or resistance zone or line and overcomes this line, the paradigm shifts. Previous support may now become resistance. In the article I wrote about candlesticks, think of the struggling recruit who suddenly finds their stride. At first, they can’t quite master a certain concept. They keep failing at an evolution and their performance score peaks and declines at the same level over and over. But then something clicks, and that skill becomes easy. The performance ceiling now becomes a floor and in a perfect world, their performance score never dips below that rating. However, it could easily go the other way for a failing recruit who showed earlier signs of promise and goes on a downward spiral to failure. As they fail over and over, they begin to loose confidence and fail on even the easiest of tasks. Investor psychology, and the associated stock price is incredibly similar. As you can see in the example below, traders broke through a resistance line that later became support as the stock price moved upwards.

Below is another example from our original stock example that might provide an early warning to anyone looking to put on a trade banking on the share price going up. Take a look at a loss of support as illustrated by the orange arrow.

Risk to Reward

Now, we can put this basic knowledge together to make a less risky trade. When putting on any trade, you should always be asking yourself three simple questions. First is, where do I want to enter the trade. Second, where will I cut my losses if things don’t go my way? Third, where do I want to take profits? From these three questions, we can calculate a risk to reward ratio. The risk reward ratio is simple. It is the amount of anticipated profit divided by the accepted loss if the trade goes the wrong way. On many trading applications, you can use the risk to reward ratio calculator to quickly make better investment decisions. Here is an example, using the same stock of a risk to reward ratio.

In this example, I am committing to buy shares of this stock when it touches my support line at around $2.10 per share. I have identified my trading version of an anchor point to make a well informed and well protected attack on the market. In this example, I anticipate the stock price moving up to $3 a share where I will take my profits. I will take profits a little before then at say $2.99 per share. This would result in 89 cents per share of profits. I will cut my losses if the stock price dips below my support line. I’ll give it a little leeway as nothing in the market is perfect and sometimes price moves downwards slightly while the overall trend can stay intact. For this example, I am selling if the price reaches $2.01, or a 9 cent per share loss. 89 divided by 9 gives me a risk to reward ratio of 9.89. In other words, I am risking 9 cents a share to make 89 cents per share. In a perfect world, I look for trades that would give me a risk to reward ratio of at least 3, so this trade would be a great one! But let’s face it, I am writing this article because I am doing something completely different, and I need to stop it. I AM NOT TRADING FROM AN ANCHOR POINT. I AM “DIDDLING IN THE MIDDLE” AND I NEED TO STOP.

Diddling In The Middle

This phrase was brought up on the Wolves of Wealth Community Masterclass one night the past month. They said “if you diddle in the middle, you’ll get the fiddle! Always, always, always trade from a level of support or resistance and set your damn stop losses!” In the last example, you can see that if you know absolutely nothing else about price action, moving averages, RSI, MACD, etc (other topics for future posts), but you can identify support and resistance lines or zones, you can make it. All of this is reliant upon trading to your plan though. You need to buy at the right price, sell at the right level and commit to cutting your losses at the right price. So how does diddling in the middle look on a stock chart? Let’s look at the same chart with different. points.

In this example, I enter the trade in the middle of my support line and my resistance zone that I marked out. Maybe someone posted something on social media that caused me to want to jump into a trade NOW! I hit the buy button without doing my homework right in the middle of the trading range. We will use the same range example. Armed with the same reference points, my entry point with associated risk to reward in the middle of support and resistance lines or zones is close to one. You never know where a stock price is going to go. Accepting the fact that anything can happen is key to being a successful trader. It could rocket up, plunge down or trade flat for months…no one really knows. The bottom line is this trade is sloppy. It’s a 50/50 trade with the same potential gain as a loss. It’s gambling in its purest form, and over time in a death by 1,000 cuts scenario, it will bleed your trading account dry (commissions for trading adds up too)!

You will be wrong a lot in trading. Hit the buy or sell button at any point in time and you will find any trade is a 50/50 chance endeavor. Add support and resistance lines into the mix and you can tweak the odds in your favor. Yes, support and resistance lines and zones fail every day, BUT statistically, they hold more often than they fail. If you commit to trading ONLY from support and resistance zones or lines and keep discipline in maintain your stop losses and profit targets around these areas, your mess ups will stay small compared to your wins. Consider if you commit to trades that have a risk to reward ratio of 3 and your success rate is now even slightly over 50%. For every dollar you risk, you expect to receive 3 dollars. More often than not, you will receive three dollars instead of losing one. You are right on more occasions even slightly more than you are wrong. You have essentially created a small edge in growing your account. It may not be the best edge. There are plenty of other more advanced trading strategies that can give you a higher probability to win, but a lot of them use resistance and support levels to add confluence to the strategy. Over time, this grows accounts, BUT this only happens IF you properly define your anchor points and adhere to safe practices around them. I WILL NOT DIDDLE IN THE MIDDLE.

Anchor Points Save Your Life!!!!

One night on the Dixie fire, after an epic day watching one of the most impressive air shows I’ve ever seen, we ventured to the outskirts of a small town called Old Station to plumb some hose lines up a bulldozer trail. The lines would be used to mop up or overhaul the fire that had burned up to the dozer lines. Long story short, in our two mile march up this trail, the wide dozer trail petered out into a narrow path with unburned fuel on either side of the line. In our last half mile or so, the trail could hardly be called an anchor point given conditions at hand. We were determined to complete our assignment.

With a time crunch on our hands, two of the crews continued on with the hose lay and the other three crews patrolled the lower section of line, putting out small fires that had burned up to the dozer trail. My crew was at the top edge of the hose line following behind the hose lay crew. We were positioned right near the point where the dozer line diminished into perhaps an extra wide hiking trail. When conditions changed for the worse, I watched two of my fellow crews (the hose lay crews) become cut off by the fire. The fire jumped the line when the winds gusted to over 65MPH. My crew was farther down the hose line frantically trying to put out smaller fires that had jumped the line and I was all alone some 400 yds or so away. As I was trying to do anything I could for the eight fellow firefighters that I feared were in the process of being burned alive, I lost track of the fire around me. An area of fire about two football fields had established above me in the unburned hillside we were trying to protect. When I noticed the wind shift back towards the burn, I suddenly became blinded by smoke and it was almost too late. A wave of fire roared back down on me. I couldn’t see anything but the small dozer line at my feet. I stumbled for my life, with one foot on the dozer line and one foot on the black (or area the fire had already burned partially). The black I was standing on was only partially burned, known as a dirty burn. If it was a clean burn, I would have dived into it for immediate safety, but with the threat of major fire, I figured bare earth with no vegetation was more tenable for evacuation than half burned vegetation. I reckoned that my dozer line would get me down and the dirty burned black would be my fallback point to deploy my fire shelter if needed. That experience was something I never in a million years would ever have imagined having to do. It was a terrifying few minutes.

Thankfully, I was able to make it back down to my crew safely. They had picked a safe spot in a very well burned black. As I caught my breath, I couldn’t even imagine what the carnage was for the crew members in the unburned fuel above me. Distracted by the task of completing the hose lay, they had not been operating from a suitable anchor point. To combine trading with wildfire lingo, they had been diddling in the middle and getting the fiddle.

Fortunately, this story has a happy ending. A bulldozer operator who happened to be in the vicinity hastily cleared out an area so that they could ride out the fire in relative safety. They made their own anchor point, something that doesn’t really happen so easily in both worlds. Ironically, the sudden change in conditions was caused by a downdraft from a thunderstorm. After the winds died down, all of our crews humbly trekked back to our rigs in pouring rain. Anchor points save lives. Diddling in the middle can get you killed.

As a trader, I should remember this story before putting on any trade. I need to tune out the noise. I need to ask myself each and every time before I hit the buy or sell button, AM I TRADING FROM SUPPORT OR RESISTANCE, DO I HAVE A TRIGGER POINT FOR WHEN TO CUT MY LOSSES, AND WHERE AM I GOING TO TAKE PROFITS? IS MY RISK TO REWARD RATIO ADEQUATE? I should have this plan and let the stock price come to the area I want to put on a trade, much like we sometimes let a fire burn up to our anchor points and containment lines. It is much much safer. I know that if I respect these concepts and have the discipline to stay the course, I will be successful. I need to treat trading with the same seriousness I treat firefighting. In doing so, I know I will be successful.

As always, stay safe and be prosperous,

-thefirefightereconomist