In my last post, I highlighted the benefits of cash secured puts in buying a stock at the price you want to own them at, all the while getting paid to wait. The firefighting equivalent, would be to scratch indirect hand line well ahead of a raging fire in order to prevent the spread of the fire. If this technique worked all the time in the wildland world, we wouldn’t have several hundred thousand acre infernos. Sometimes, even the best laid plans go awry. Sometimes the fire burns hotter and faster than any methods could predict and lines are overrun. The same is to be said with running cash secured put options. In both arenas, do we ever quit? Hell no, we reposition and attack the problem from a different angle. Here’s what to do when your cash secured puts are overrun by a plummeting stock price.

Getting Assigned

In my last example, I used the RIOT $4.50 put as an example of a stock I wished to own at the $4.50 per share price. My goal at the time of that writing was to run the $4.50 put each week, collecting options premium along the way. Since beginning of implementing the strategy, I managed to collect $91 in options premium without being assigned at that $4.50 level. This weekend, my luck finally ran out. On Saturday, I received this email notification of options assignment. Ignore the urgent and almost threatening language. Like I mentioned in the last article, if you do not use leverage found in a margin account, you really have nothing to worry about. Sifting through the language, all this email is telling me, is that I am now the owner of 100 shares of RIOT at $4.50 a share. Should I be worried? Absolutely not.

Is This Bad To Be Assigned?

Remember, the key to running cash secured puts is to own the stock at the price you want to own them at. RIOT closed on Friday July 1st at $4.24 cents a share. Sure, my put expired in the in the money. Thus, I was forced to buy the shares for $4.50 a share, netting in a loss. Because I received $10 for putting the options contract (or 10 cents a share), my realized loss on this trade was the difference between the share price and options listing price offset by the premium from the contract. This totals to a loss of $16 ($424-$450+$10). If I total all the premium I have received on RIOT prior to getting assigned ($91), In reality I am up on the trade by $75, or a 16% return rate on investment of $4.50.

So what is RIOT? It is a Bitcoin mining stock heavily correlated to the price of Bitcoin. BTC has been taking a massive beating the past few months and is trading at levels consistent with a local low point. Over the next few months, either BTC implodes to zero and RIOT goes belly up (and I loose $450) OR Bitcoin make a recovery back to new, higher levels. The 1 year high for RIOT was $46.28 and the all time high was $79.50. As you can see, I now own an asset with a high upside potential compared to my downside risk. These are the types of investments I personally want to be in, but can I do more to gain? Absolutely! Enter the covered call strategy.

Covered Calls

The sister to puts, call options are the inverse strategy of puts. To put things very simply, if you buy a call option, you are thinking the price of the underlying stock will increase. By holding a call option, you can make a lot of money if the price of the stock increases in the time you hold the option. The closer you are to the stock price, the more expensive the option, and the more you benefit from these upward moves (or get destroyed if you are wrong). Like put options, there are buyers and sellers. If you sell a call option, you are thinking the stock will stay flat or even decline slightly. If the price of the underlying stock never hits your price point, you get to keep your option premium for selling the call. Unlike puts, where the maximum loss is capped by the stock falling to zero, selling a call holds unlimited risk (the stock could rocket to the moon as the kids these days say). If you are trading in an account that offers margin, you can sell a call option with this risk. This is what’s know as selling a “naked” option. There is no backstop to protect your losses. I don’t recommend doing this. The safest way to sell a call is to collateralize the call with stocks you already own. If you own 100 shares of a company, you can sell a covered call option. The shares you own allow you to do this.

In my example of RIOT, because I was assigned 100 shares of stock at $4.50 a share, I can use this asset as collateral to sell a covered call option. If the stock price shoots beyond my options contract, I will be forced to sell my stock at the price on my options contract, but I would not be exposed to the unlimited risk associated with selling a “naked” option. There are some things to consider before putting this trade on. First you want to ask yourself the inverse of selling a put option. In a put option, you ask yourself, at what price do I want to own the stock at? When selling a call option, you ask yourself, at what price point do I want to sell my stock at? In the case of RIOT, I don’t believe BTC has reached a bottom yet, but I believe we are close (RIOT too). I think there is some opportunity to perhaps acquire more shares at a lower cost. I see the possibility for this stock to fluctuate up and down over the course of the next few months at this lower range, so I am comfortable selling whats know as an at the money, or ATM, call option. I will sell the option contract at the cost I acquired the shares I own at (thus at the money). The key to selling covered call options is to do your best to never sell a call option below your cost basis. In this case, my cost basis is $4.50 a share. In this example, I will put on a $4.50 call option when the market opens tomorrow.

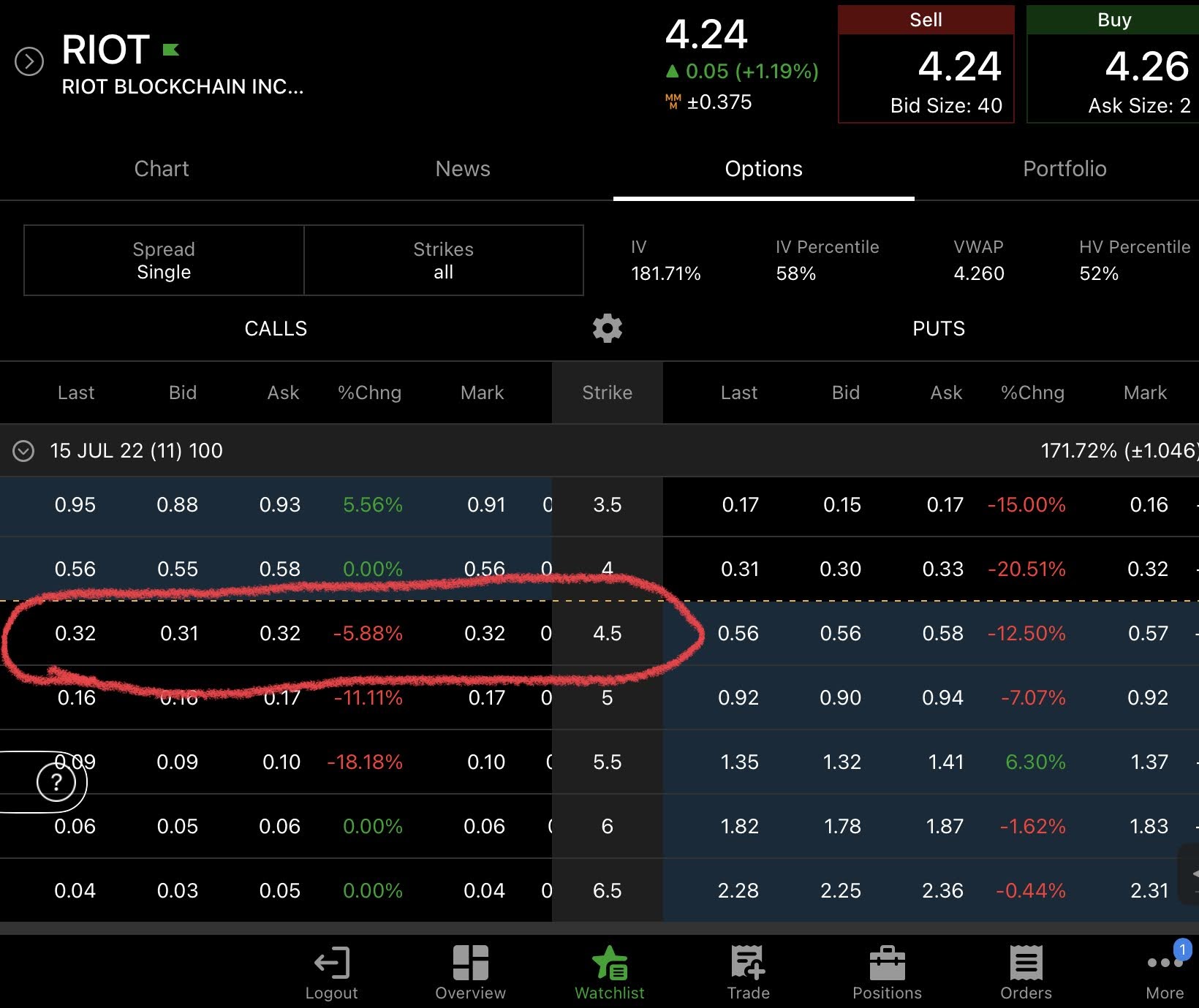

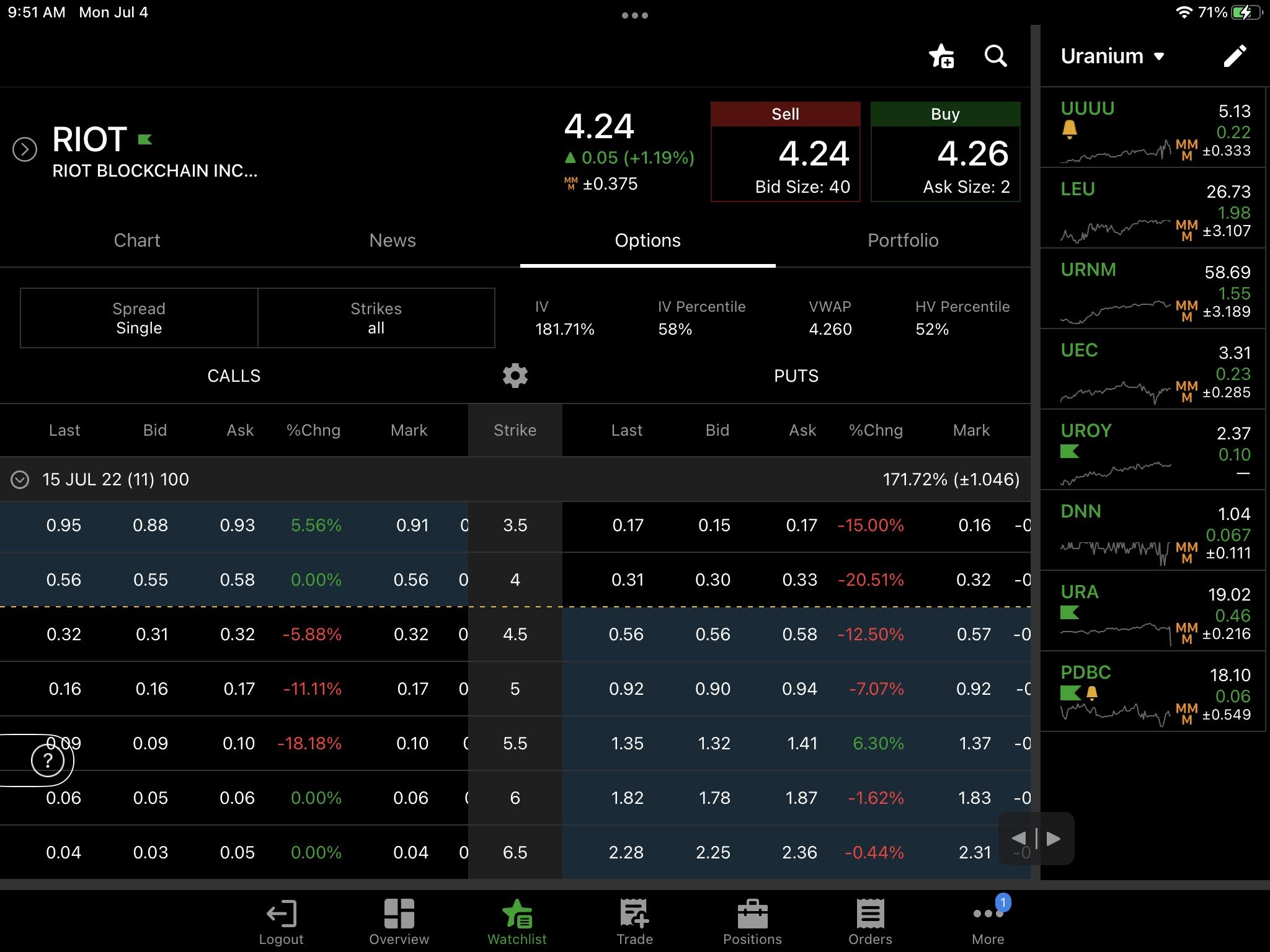

I have decided to pick the July 15th $4.50 option to sell. I will receive $31 for putting on this trade as seen on the options table. So let’s go over the possible scenarios for the July 15th expiration date:

- The stock price stays flat (does not change). I still own the stock at a small loss ($26 to be exact). However, my trade does not expire in the money, and I get to keep the options contract profit $31 from $450 of the stock value results in a 6.9% return on capital, just for owning the stock at $4.50 and being willing to sell the stock back for $4.50 a share. I can put on a new trade for the same amount or higher strike price.

- The stock price declines significantly. I still own the stock at a larger loss, but the options trade still nets me 6.9% of the trade. In this case, I am wondering if my initial investment thesis is correct. When I go to sell the next $4.50 call option, the premium I will receive will be lower due to the stock price being further away from my strike price.

- The stock price rockets upwards. This is still a winning trade, but I missed out on a lot of profit due to my shares being called away at a lower price than what I could get by not putting the contract on and selling my shares on the open market. Evaluating likely trends in the stock price movement can save you a lot of heartache in the long run if you aren’t willing to part with your shares this early.

In all of these cases, I am still winning on the options trade. A lot of investors take a buy and hold strategy of holding stocks for the long term. As you can see, if the prices stay flat or even decline slightly, but if your cost basis is close to or below the share price, you can squeeze some extra money out of the assets you own, with minimal risks. The key risk management factor in this is to not sell a call option that is below your cost basis. For instance, I would not want to sell the $4 call option on RIOT if my cost basis is $4.50 a share. If you are looking back at the options table and calling BS on my RIOT example, I applaud you, but would like to point out something. In this case, the premium received for selling the $4 call would be $56, resulting in an overall gain of $1 if the stock rose above $4.50. However if you just sold the $4.50 call option, you would net $30 more for the same risk of getting your stock called away. In general, just don’t sell calls below your cost basis. In most cases, if your shares get called away, you may ultimately loose money. If you can stay disciplined in following this rule, you will never loose money from these options trades.

The Share Price Continues To Plummet?

If the share price of the stock continues to plummet well beyond your cost basis, it’s time to evaluate your investing thesis and weight out some options.

1. If things with the asset have fundamentally have changed, it might be prudent to sell at a loss to avoid further pain.

2. You may chase the price down by selling covered calls below your cost basis, but beware! If the stock price reverses, you may be stuck selling your shares at a loss.

3. Average down using call option premium. Many investment advisors don’t recommend averaging your prices down, but I don’t have an issue doing this if my investment thesis is still strong. You can use the premium received from selling your covered calls to buy shares of the underlying stock at a lower price which averages your overall cost per share down. Perhaps you do that enough and your average price per share takes you to the next call option strike price (for instance if I averaged down enough on RIOT and my cost basis reaches $4 a share, I could safely sell the $4 call option without loosing).

4. Average down with cash secured puts. Utilize the techniques in my cash secured put article to sell a cash secured put below the share price. This all comes down to your desired position size for the asset in question. Say I was willing to allocate no more than $800 to RIOT, I could sell the $3.50 put option. If that put option is reached, I would then own 200 shares of RIOT at $4 a share (the average of $4.50 and $3.50), and then could sell two $4 call options per contract period. Overall, be disciplined with you investment thesis and position sizing if you wish to pursue this option. I tried this once with APPH last year with disastrous results. The share price plunged from $8 a share down to under $3 a share. I should have sold at a loss and revisited the stock at a lower price. My research wasn’t there, I didn’t have a solid investing thesis, and I was way less disciplined about my trading than I am now. I was able to average down with cash secured puts that would occasionally get assigned, lowering my cost basis so that I could run more aggressive covered calls to get called away at break even. I discovered I had about 30% of my portfolio allocated to APPH at one point. This is a huge rule breaker for me, as I strive to have no more than 10% devoted to any given stock. It was bad technique, bad investing, and although my outlook on APPH is better now at these lower prices (better upside reward compared to downside risk), I am not happy about how I invested in this stock using cash secure puts and covered calls. Lesson learned (doh!).

Best Case Scenario: Covered Calls to Cash Flow Your Shares

Covered calls allow you to extract extra yield on stocks you own already. I love putting on covered calls on many of the growth stocks I own. Growth stocks inherently don’t pay dividends. They are called growth stocks because the business uses profits to grow their business instead of paying dividend. Shareholders benefit from a rising stock price rather than an income stream from dividends. If you are looking for some income while betting on the newest technological advancements of your favorite companies, covered calls are a great way to generate a bit of a “pseudo-dividend” yield. Because these stocks often have volatile price moves up and down, options premiums that you can collect are usually higher on growth stocks than income stocks (more stable companies or index funds that pay a steady, consistent dividend). First, you will need to determine if the stock price is above your cost basis (your average price per share). Also, you want to evaluate where you see the price going, and what price you want to sell your shares to pursue other investments. Your so called pseudo-dividend yield is determined on how willing you are to part with your shares. The closer strike prices to the stock will generate more yield. In the case of RIOT, again, I think the price will stay flat or possibly even decline slightly. I will be a bit more aggressive over the next few months and sell covered calls closer to or even at my cost basis to generate an aggressive yield. However, if I thought the price was going to start to go up and I wanted to benefit from this while also having a reasonable chance of holding onto my shares, I would be less agressive in my call writing.

I would simply sell a father out of the money call option (or OTM call option). Back to the table, say I decided to sell the $5 call option instead. By selling this option, I am agreeing to sell my shares (that I bought for $4.50 and is currently trading for $4.24) for $5 if the strike price is reached. Based on the options table, I receive $16 for putting on the trade. Let’s go over the possibilities at July 15th expiration.

- The stock price does not hit my $5 mark at the time of expiration. I keep the $16 and my shares are not called away. This results in $16 “pseudo dividend” payment for my $450 investment or a 3.5% return on investment.

- The stock price declines further. I still have the 3.5% return, but in hindsight, selling the ATM call option at $4.50 a share would have netted me a better yield of 6.9%. Sometimes that’s the price you pay for being conservative.

- The share price blows past my $5 call price and I am forced to sell the shares. My overall profit in this case would be $50 (.50 per share difference between my cost basis and the sell price) plus the $16 premium received for a total of $66 profit from a $450 investment, or 14.67%…all and all not bad, but it could have been better.

If you wish to retain your shares AND cash flow them, the best outcome is to sell above your cost basis at a level that still provides yield AND does not result in your shares being called away from you. Figuring out what the sweet spot is, is the crux of many investors. All and all, holding any stock that has options contracts allows you to do this. If you can stay ahead of a rising trend on your options strategy and never have your shares be called away, you can reap the benefits of income stocks by collecting options premiums AND benefit from the rising share price.

Unlimited Return

Say you inherited a house you never wished to live in. The house is paid off, but the hosing market has crashed. You own this asset free and clear (lucky you). What do you do though? Sell it or rent it? By selling the house, you miss out on potential gains in the future when perhaps the hosing market takes off again. You live in regret. What if instead you rented the house out? You now have a monthly rent flow. You have an income stream that short of the house burning down in a rippppper will provide you with an income stream. What if the housing market tanks more? You’re still collecting income. What if the housing market booms? Perhaps you can up the rent, collecting even more income. You have next to zero risk with a steady source of income independent of the underlying value of your home. This dream draws many people to the world of real estate for good reason. I see a lot of firefighters wanting to get into the world of real estate investing in one of the largest housing market booms to date. They are looking for the best deals to perhaps cash flow $100 on rent for a house that is bloated in value…if cash flow is what you are looking for, consider covered calls as a way to accomplish this goal with less money. Consider building an unlimited return section of your overall portfolio. The steps are simple on paper, but trickier to do in real life. This concept can be applied to every asset class.

- Buy an asset cheap

- Sell enough of the asset to get your cost basis to zero (eliminate risk). Say I had 200 shares of RIOT at $4.50 a share and the price spikes to $9 a share. If I sold 100 shares at $9 a share, I now own 100 shares of RIOT free and clear.

- Cash Flow. In the earlier example, this is rent from the house. In the stock world, this is collecting dividends on income stocks OR selling covered call options against stock holdings.

If you can accomplish these three steps, you own an asset free and clear and are getting paid to own it. The path to achieving this outcome has risks, but once you overcome them, you are generating completely free cash flow. The markets can go up and down, but you are collecting income from them. In boom times, the returns will be higher. In slowdowns, the returns will be less. However, you do not need to monitor your risk of loosing your money originally invested because you have eliminated this. That asset is now generating you an unlimited return rate. Lather, rinse and repeat, and you can build a robust portfolio that provides you an income stream no matter what the overall market is doing.

In summary, when your cash secured positions are overrun by a rapid decline in stock value, you may be a bag holder of a declining asset. Much like a hand crew’s line getting overrun by a rapidly advancing fire, a quick pivot of tactics can lead to winning results. Covered calls are an incredible strategy to recover from a loosing position, or to cash flow a winning or neutral stock position. When coupled with an asset where you have completely eliminated the risk to your original investment, they can be a source of incredible risk free returns. I will be honest when I say I haven’t yet built an entirely risk free, cash flowing stock holding. My experiment with RIOT is the first such push to achieve this result. On the road to financial freedom, you will need to acquire knowledge and tools to help you become financially agile in this crazy world. For the beginning stock and options traders, covered calls and cash secured puts are great ways to get your feet wet into the world of cash flowing stocks. As always, be safe and be well.

Happy Fourth Of July

-thefirefightereconomist