Now more than ever, it’s time to develop an investment thesis…here’s mine after some wandering….

It’s easy to do at 2am. You get the call for a structure fire as you wipe the sleep from your eyes. The adrenaline surges as you make your way through the dark and empty streets to reports of people possibly trapped inside. On arrival, you see heavy black smoke pumping out of every orifice in the building. You rush to the front door, mask up and dive inside the boiling cauldron of smoke. After some stumbling around in the darkness, you can’t find the fire. You can’t see anything, not even the hand in front of your face. You ask yourself, how many stories was the building? What is the probable layout? Was there anything in the notes on the MDC of the fires origin? You though this would be easy. You’d be able to find the fire no problem, rescue the victims, and save the day like it was second nature…but then the utter truth smacks you flat on your ass. You rushed in with no idea what the hell is going on, and you are getting caught in the hubris of your own ego. You are stumbling over chairs, into walls, and over what you think is a couch. No heat is registering on your thermal imaging camera that you can barely see. You are lost without a plan.

You make the decision to back out and get a little bit more information. You quickly interview the neighbors. You read the smoke and building construction a bit more intently from the outside. The neurons in your brain connect with your training and previous experience, and you jump back in the darkness. It’s still smokey as all hell. You still can’t see anything, but armed with some basic situational awareness, you move through the unknown armed with probabilities. The victims are most likely on the second floor where the neighbors said the bedrooms were located. The stairwell is most likely on the left side of the building where that course of diagonal windows rose upwards, and the fire most likely started a back living room area on the first floor because that’s where the most amount of turbulent smoke was coming from. You still stumble and bump into things, because well no one ever said fighting fires in zero visibility conditions was easy, but armed with probabilities, you and your crew make your way easily to the seat of the fire on the first floor and your adjacent crew is able to make their way to the second floor to conduct a rescue.

To rush into any investments right now without a solid plan is a recipe for disaster. You may as well be stumbling in the dark smoke of a well involved structure fire. The implications of Russia, Ukraine and the possibility of the dollar loosing it’s world reserve currency status amidst a probable global recession is most likely a tell tale sign to take a pause for reflection. It’s time to back out a bit and evaluate what may happen in the near to long term, develop an investing thesis, and execute accordingly. A lot of people fail to realize that there are always two sides to any trade, a winner and a looser. If we can appreciate this, there is nothing, save for nuclear annihilation, that can’t prevent us from profiting in this economic downturn. It is merely a matter of being on the right side of an appropriate investing strategy. It’s a lot like being a firefighter diving into that turbulent black smoke.

Just because something looks impossible doesn’t mean we can’t put the fire out and rescue the victims, it will just take a bit more planning and situational awareness. In the investment world, this calls for anticipating what our markets will do. This is called an investment thesis. Once you develop a thesis, you can then find opportunities in markets to invest according to your thesis and personal investment rules. Before we get into the weeds, I want to simplify my thesis with a few basic ideas. Quite simply, inflation is slowing the economy down and we are seeing exorbitant prices for commodities. We have not been investing in our commodity sourcing and production infrastructure over the past decade due to cheap commodity prices. Commodities that are necessary to survive are going to price the poorest people in the poorest nations into starvation and abject poverty, more than we have ever seen. The Russia/Ukraine conflict just a catalysis to this problem and will lead to further global conflict independent of whatever ambitions Vladimir Putin has or will have. These conflicts will make parts of the world off limits for investments short term, but in the long term will have some fantastic buying opportunities. Businesses in investable regions of the world that can efficiently produce or extract commodities at lower cost will be generational wealth building opportunities. Note, that all of these ideas center around commodity prices.

Part 1: Commodities 101

What Are Commodities?

Commodities are the building blocks to every thing tangible that you wish to own or consume. Base metals, precious metals, agricultural products, gold and silver, natural gas and oil are all in the class of assets, known as commodities. In his book Hot Commodities, author Jim Rogers lays out all of the various commodity markets and how they are sourced and traded. He brings up a great example of why paying attention to the price of commodities matters, by highlighting a well known breakfast brand. If you are Kellogg’s Cereal company, you are incredible sensitive to the price of commodities such as paper, wheat and oats. Any staggering price change will cripple a company that relies heavily on commodity prices. In today’s overall inflationary environment, commodity prices for Kellogg is incredibly important. Wheat prices are skyrocketing right now, looking like a meme stock or a crypto currency. Is that company going to raise the price of a box of cereal to $25 to keep their profit margin, or will their stock price take a hit with reduced profits? The commodity market is governed heavily by the laws of supply and demand.

Commodity Supply And Demand

Reread the article on supply and demand. Recall that prices dictate how much of an item people are willing to buy given their demand preferences, and how much suppliers are willing to supply given their costs. If a price for something is too high, people will not wish to buy it. However, if prices are high relative to production costs, commodity producers will produce or extract a lot of commodities because of the price they can get for it. If you could make $5,000 for something that costs you $100 to produce, you’d be ramping up production to full capacity to cash in. This will raise supply and ultimately lead to a lower price. Commodities can be incredibly volatile in prices, causing headaches for commodity producers relying on a stable price to guide production numbers and businesses relying on stable input prices to produce their finished goods and services that they sell to consumers (us). Thus, most commodities are traded in the futures markets. Futures contracts are contracts that businesses buy and producers sell in order to smooth out their business forecasting. They are obligations to buy a certain quantity of a product at a set price at a date determined on the contract. Kellogg can buy futures contracts for their paper, wheat and oats and know what their prices will be in the future. However, that future only extends so far and prices can go both up and down over time with various risks along the way for the contract holder and the contract seller. For instance, it would not make sense to buy wheat 20 years in the future. What if some new variety of wheat is developed that revolutionizes the efficiency of wheat production and the result is a price per bushel of wheat that is half the cost of today’s price? The farmer makes out like a bandit in this case. If you were Kellogg in that scenario, you have just destroyed twenty years of future profit margins as you are obligated to buy wheat at a higher price. But what if inflation takes over and the cost of wheat triples? Kellogg would be looking pretty good and the farmer would go out of business. There’s no way to accurately predict the future. Although futures contracts smooth out short term prices swings, they are hard pressed to quell any violent long term commodity price pressures. Ultimately the law of supply and demand prevails. Higher prices will lead to more production and extraction of commodities to bring prices back to equilibrium. However, there are caveats to these mechanisms in the commodities markets.

Time Delays and Reserves

Supply increases in commodities is a slow moving apparatus. Sourcing and producing commodities takes time. It takes a whole season to grow an extra crop of wheat. It can take almost a decade to bring a new oil well up to production. These lags in time can do a few things. For goods that people can go without, you will see a shift in demand and perhaps a new set of consumer preferences. If it is a good that is vital to the survival of your family, you might see absolute social unrest emerge as it take a whole weeks wage to put bread on the table or keep your home heated in the dead of winter. Faced with enough price chaos, you will see governments step in. They have planned for such mayhem. Governments can implement price controls. They can nationalize private industry under the guise that they can do things better. They can also release strategic reserves. Many commodities have strategic stockpiles to account for such desperate times in supply. These supplies can be released into the market to quell any hysteria from the demand side of the equation. This will keep prices lower and act as a buffer to absorb any specific market shocks. If you are an engineer pumping a large warehouse fire and you suddenly loose substantial water from your hydrant for a short bit of time, you can appreciate this mechanism. The strategic supply is your onboard water tank. You can open your tank to pump valve to supplement the reduced water pressure from the hydrant and maintain an adequate fire stream. When the hydrant pressure restores, you can close your tank to pump and refill your engine’s water tank. Governments do the same, replenishing their strategic stockpiles of essential commodities when said commodities are priced lower. But what happens if your water tank runs dry and your hydrant pressure is still dwindling? Quite simply, you are forced to watch the world burn….

Russia/Ukraine and The Commodities Perfect Storm

The current Russia/Ukraine conflict is occurring under a very important backdrop for commodities. The COVID 19 pandemic caused massive deflation for certain commodities such as oil as a lot of economy was shutting down. People drove less and took to Zoom meetings. Demand for oil plummeted. In fact, in 2020, oil futures markets went negative! Essentially, on paper, oil companies were paying you to buy their oil. If you had scooped up these shares of oil producers and futures contracts, you would be doing pretty well. Oil has been trading at over $100 a barrel for the past few weeks at the time of this writing. With demand dwindling, and COVID lock downs, many commodity mining and exploration industries shut down or severely reduced production. A term you will hear often when evaluating how efficiently a commodity producing company is operating is called all in sustaining costs. Simply, it is the total cost to produce a unit of a commodity. For instance in the gold market, a gold mining company might have an all in sustaining cost of $1,400 per ounce of gold. If gold is trading at $2,000 an ounce, that mine is profiting $600 per ounce of gold pulled from their mine. If you are a commodity producer, and the deflationary forces of COVID 19 causes demand to drop to a level below your all in sustaining cost, you are forced to shut down. This is exactly what happened during COVID 19 lock downs for a number of commodity producers. As we mentioned previously, there is a time to restart operations and bring those valuable commodities back into the market. When the COVID 19 lock downs lifted, and demand surged, we were met with a sluggish response in supply, inherent in many commodity industries. Add in the inflationary forces of COVID relief payments to millions of American families and businesses, and you have essentially added fuel to the fire.

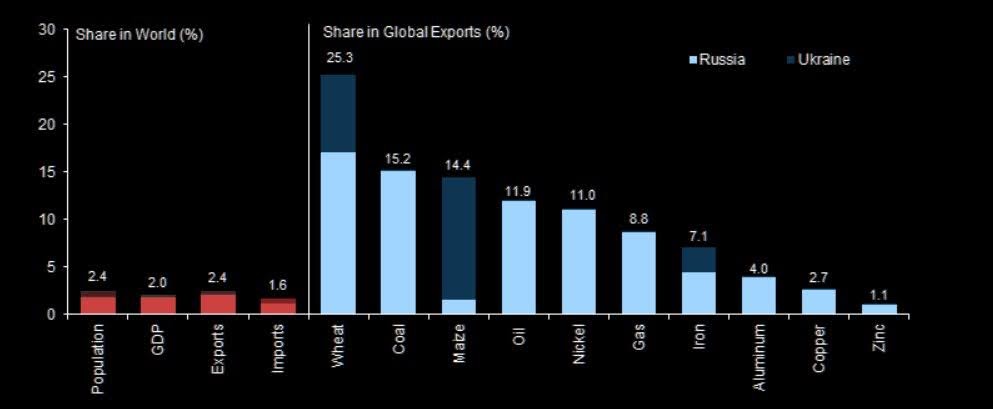

The Russia and Ukraine conflict may seem a world away, but it is causing extreme price shocks to a recovering commodities market. This Bloomberg article does a great job breaking down the direct impact these two warring countries have on the commodities market as a whole. The impact is not pretty. Sanctions against Russia and by Russia against the US and EU will likely remain in place, even if a peace agreement is reached between Russia and Ukraine, furthering the strain on commodity markets. This will further lead to increased prices for commodities, especially the ones we import heavily from Russia.

Ripple Effects: The African Connection

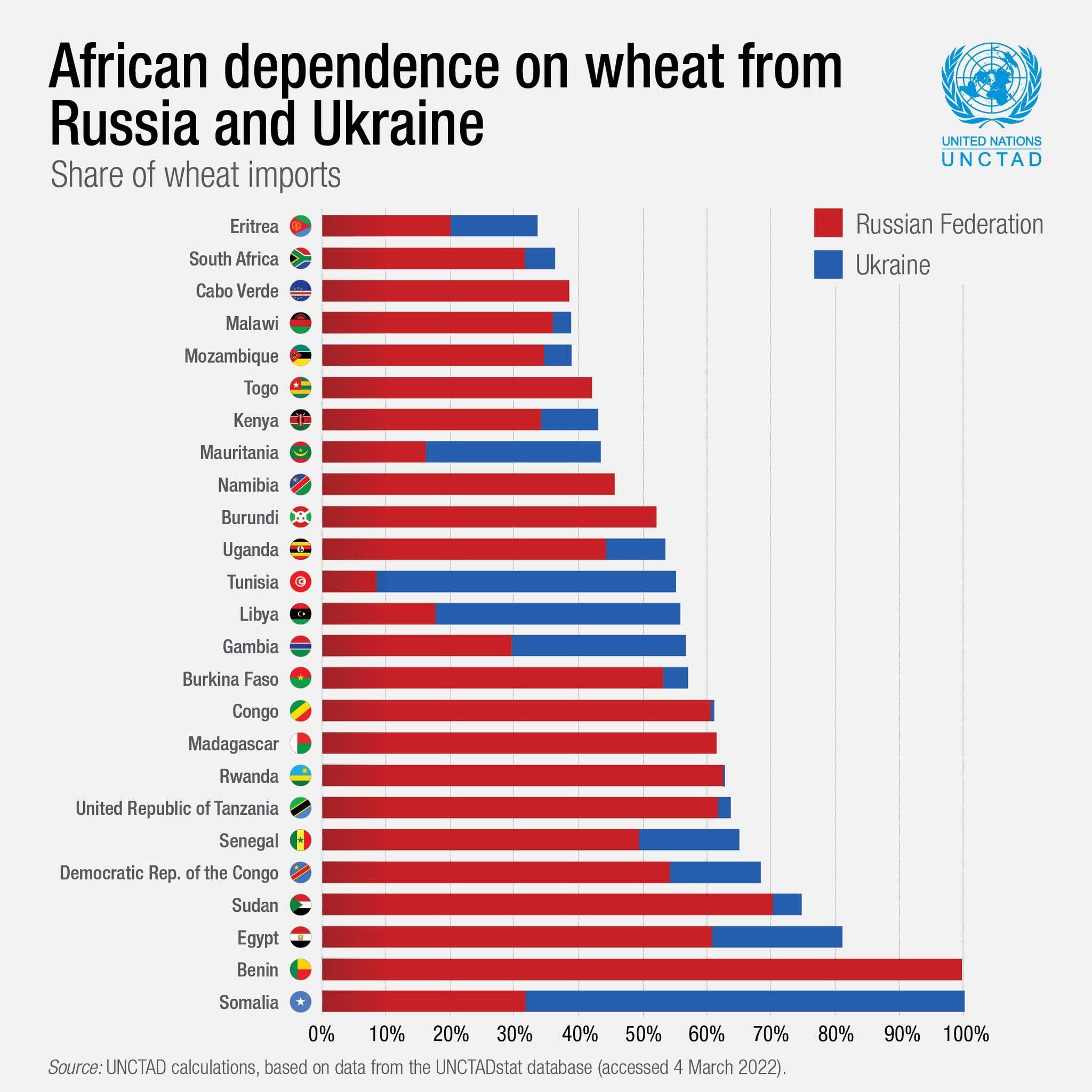

I’ll tell you this much. Raise my gas prices more. I’m not happy, but I will make due. Maybe I’ll even dust off my old beach cruiser and ride the seven or so miles into work, heat my house less, and not fly on a plane to go on vacation. Raise my grocery bill four times over and make it all but impossible to feed my family, and I’m going to have a lot more to say and maybe do about it. Yes, I know this sounds privileged, and that’s the point. I am blessed to live in a first world modern society. Now imagine if my wages were already low, my primary source of income was subjected to the ravages of inflation, AND my source of grain was all but cut off due to war…well behold this shocking statistic.

The African continent is host to many commodity resources and represents a vital emerging market for commodity producers. However, there are significant geopolitical factors and infrastructure challenges that make investing in these markets challenging. Resource investor and financier, Marin Katusa has mentioned this many times across many interviews and publications, when he says that stories of remote jungle mines that you need to access via 4×4 wearing a bullet proof vest sounds super sexy in an investment journal, but when the rubber meets the road, these make for incredibly risky investments. In order to dodge nationalization by a greedy government, expensive infrastructure requirements that increase all in sustaining costs, or armed militias gunning down workers with AK47’s, Katusa prefers to invest in countries that will most likely respect the rule of law. This was all before a major food source for the African people has all been cut off by the Russian/Ukraine War. I think Mr. Katusa’s strategy is even more now in play. This is a hunch, as all investment thesis are, but I would say this food supply shock will lead to food insecurity, and food insecurity will lead to people and governments in these nations to take drastic actions. I believe this will directly impact this emerging commodity market as they rightfully struggle to stay alive. This will further compound our problems in the global commodity market. When investing in commodities markets, it is important to pay attention to such geopolitical risks.

Part 2: What Are We Going To Do About It?

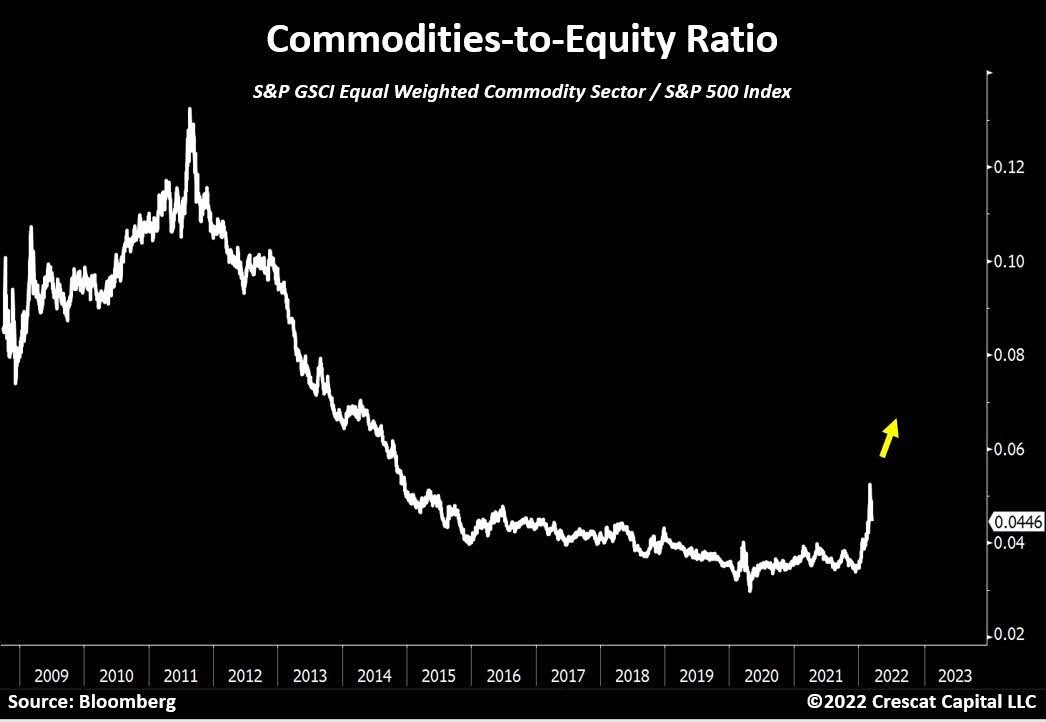

Historically, commodity prices are cyclical, and negatively correlated to the stock market. It makes sense to me. Think about this, if you were given cheap and abundant natural resources, what would you do with them? You’d move mountains with cheap oil. You’d build facilities the size of small cities to create, innovate, and develop products on the cheap for the world to consume. But what about the commodity producers, the red headed step children of the investment world? What have they been doing during this time frame?

Cheap commodities means narrow profit margins and tough business. You’re operating a hair above your all in sustaining costs in a world that is hard pressed to appreciate your endeavors and pay you accordingly. Inflation of commodities necessary to produce other commodities (i.e. diesel to fuel your heavy machinery rising in costs) eats away your slim margins. You are forced to innovate to survive. That, or you take over smaller businesses in your industry that are underwater and in need of your vision. The whole world is letting the good times roll and you are living check to check. All the while, vital investment money that should have been devoted to sustaining the commodity sourcing, extraction, refinement, and distribution has been squandered away on unrelated technology, social programs, and other fluff, relying on the cheap materials you struggle to produce. Eventually this lack of infrastructure investment catches up. Wells run dry, fields fallow, and future contracts are unable to be met due to a dwindled supply. Cue the start of a commodities bull market. When the cheap input costs are suddenly not cheap, and the finished goods and services become more expensive, associated stock prices fall as profit margins dwindle. Investment dollars pivot from technology and innovation into getting our commodity supplies back to being cheap. This can be visualized by comparing the S&P 500 to the commodities index. After scouring many online sources, I believe, we are in for a great decade in the commodities sector. I’d like to lay out a few commodity plays that are part of my active portfolio, and on a watch list for future investments.

Basic Commodity Investing Approach

Before we get into the details of some of my investment ideas, it would be wise to touch on the methods of investing in commodities for the average retail investor. For investments in any sort of commodity that you would pull from the ground via mining, there are a few different ways to invest. You could buy the commodity outright. In the case of gold and silver, this is fairly easy. I wouldn’t recommend buying uranium to store in your gun safe, nor do I believe this is possible. However, you could buy stock in companies that store commodities. Sprott Uranium Physical trust is a great example. It buys up uranium and tracks the spot price of uranium and would be the closest thing to buying the real thing. Another option for a mined commodity is to invest in the mining companies themselves. Doing so allows for a leveraged return on the spot price of the commodity, but it is a risky endeavor. Mining operations can and do fail due to a number of reasons. You either win big, or go to the poor house quick. You can hedge your risk by buying a mining ETF that has a basket of various mining stocks to hedge your risks at the cost of a lower return than striking it big on that one outstanding mine. Katusa’s approach in his investment strategy is to invest in royalty companies, which finance mining and exploration operations. In return for the financing, the royalty companies get a percentage of all proceeds from uranium mined from the ground. If the price of a commodity skyrockets, it is the best play in my opinion. Mining operations wish to be profitable, yet input costs such as labor, heavy machinery, and diesel can soar leading to decreased profit margins. Royalty companies are largely insulated from such expenses, thus in times of input cost inflation, you would expect to see those share prices increase. Now for some commodities that I have my eye on…

Agriculture Technology

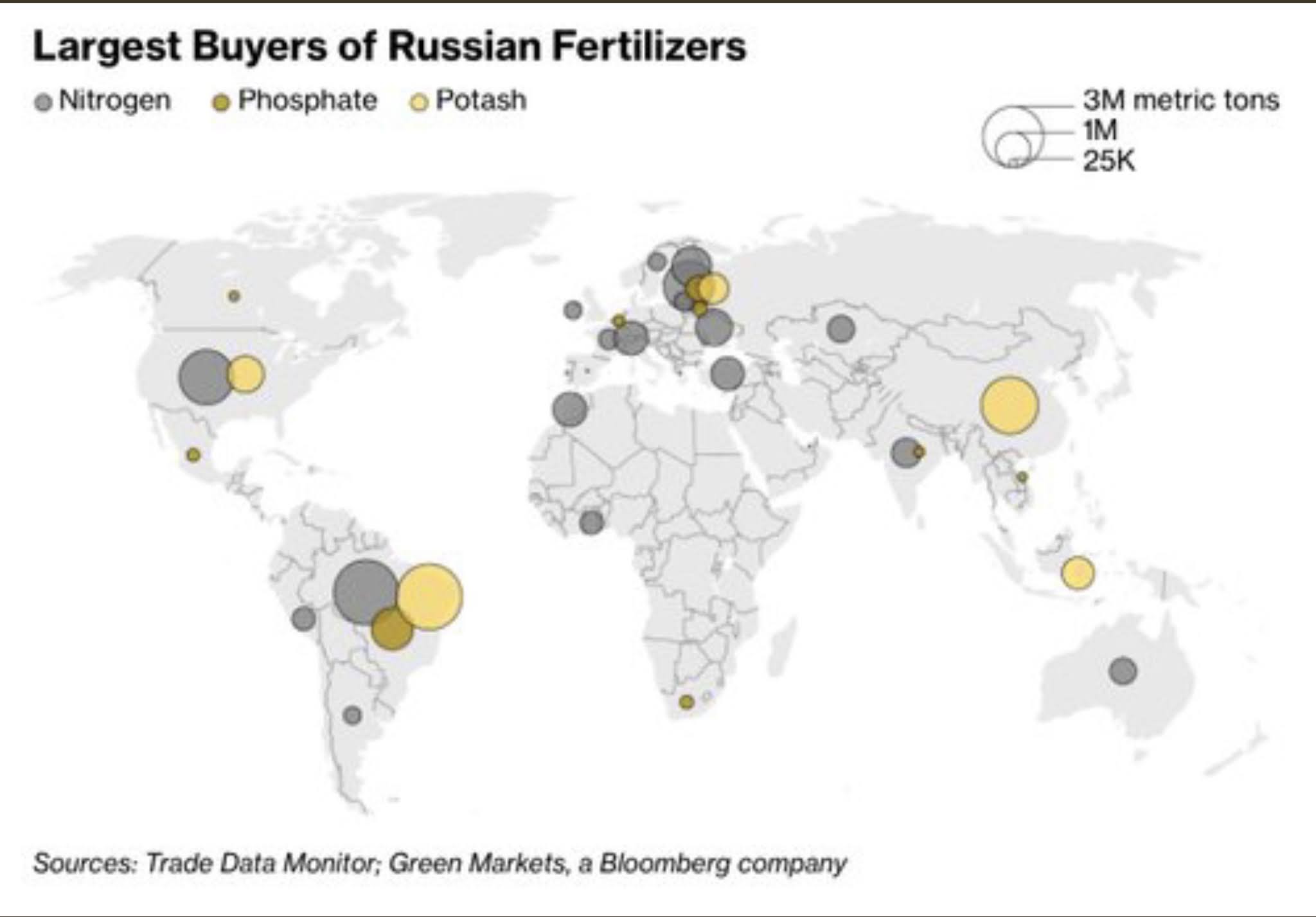

The Russia/Ukraine conflict isn’t the only factor in this investment idea, but it is a predominant one. We imported a lot of fertilizer from Russia, and that market is closed. Rising fertilizer prices will raise production costs of farmers dependent on fertilizer. Russia and Ukraine produce about a quarter of the world’s wheat, and although we don’t import substantial wheat from these regions, the impact will most likely raise the price of wheat worldwide.

Living in the heavily agricultural state of California, I am very aware of how little rain we have had this year. The crews at my station staff a state OES Brush Apparatus that responds to wildfires statewide, and we are fully expecting to be out on a rotating basis all summer. According to an article posted on npr in February 2022, “the Western U.S. and northern Mexico are experiencing their driest period in at least 1,200 years.” The subsequent policy decisions by our state’s lawmakers will most likely have a huge impact here in our state’s agricultural industry. All of these factors will contribute to a general rise in food prices.

I have several investment ideas for this conundrum. You could invest in an agricultural ETF, that would benefit from rising food prices. There are many out there for you to research and invest in. Most have been showing a steady rise in stock prices. I think it would be a safe investment over the next few years, given a rising global population, steady demand for food, and challenges to food production. For a riskier play, I am very interested in finding companies that seek to grow food at a lower all in sustaining cost and one that has less reliance on fertilizer, pesticide and water inputs. Although a newer company, with spotty earnings reports, I like what the company AppHarvest (APPH) is doing and will be following them closely. On their companies homepage, they state they use 90% less water than conventional farming with up to 30x yields in their indoor facilities. Currently, they are only growing tomatoes, but are set to expand to leafy greens and berries in the coming years. They also purchased RootAI, which seeks to make advances in automated farm production and quality control. Located in Kentucky, they are also within a days drive of 70% of the US, reducing the need for rising fuel costs. After their indoor growing facilities are fully operational, I believe they have a shot at maintaining a low all in sustaining cost and insulation from the perils that traditional farms face such as pests and drought. Again, this is just an idea. Please do your own research.

Uranium

Necessary for nuclear power, uranium is another commodity I am watching closely. Sanctions against and from Russia will likely be a catalyst for an already growing market. Uranium markets took a massive hit after the 2011 Fukushima meltdown and subsequent disaster. Spot prices for uranium plummeted afterwards, reducing the incentive for most global producers. Global suppliers outside of the sphere of influence from Russia declined in production. Kazakhstan’s Kazatomprom is the world largest producer of uranium. Despite the plummeting price, the foreign currency exchange has allowed them to continue producing at heightened levels and still be profitable. With the green energy movement in full play and increased prices for nuclear alternatives such as coal, oil and natural gas, demand for uranium has been growing. Spot prices have almost recovered from pre-Fukushima levels. But uranium alone isn’t the whole piece of the pie. It needs to be enriched, or processed, in order to be used in a nuclear reactor. Russia has contributed to a sizeable amount (approx 16%) of our enriched uranium fuel. Talks of sanctioning Russian nuclear is on the table of our government officials, and most likely on the desks in Moscow as well. Marin Katusa’s book The Rise Of America gives a very detailed deep dive into the uranium markets. His overall case for uranium and it’s importance in our future energy usage is very compelling.

Gold/Silver

Both historic stores of value and a necessary metal for industry, these two metals are in real terms historically undervalued. Macrotrends has some phenomenal charts that help you decide when the right time to buy gold and silver is. My favorite one to watch is the S&P500 to gold ratio. As you can see, the tide in an early phase of moving in favor of gold. Your investment dollars are always chasing a return and they always have opportunity costs. For me, I take a page from economist George Gammon’s strategy of buying things when they are cheap in real terms and sell them when they are expensive. Although gold and silver vary greatly in price, historic gold and silver ratios are something to pay attention to when deciding whether to invest in gold or silver. Right now, a vast majority of my precious metals investments are in silver.

There are a number of plays for gold and silver. I think having a bit of physical gold and silver on hand is a great idea. There are numerous online retail stores that you can order physical bullion from. These are long term stores of value, not meant to be bought and sold within a year or two (capital gains tax on bullion is insane!). When shopping around, pay attention to the premium price. The premium price is the additional cost over the spot price. Gold and silver prices have historically been manipulated by big banks in the futures markets, and the premium prices charge by bullion dealers gives a better indicator as to the true supply and demand constraints facing the gold and silver market.

If you do decide to buy stocks that track the price of gold and silver, pay attention to the amount of gold and silver that is actually backing the stock price. Gold and silver serve as an insurance policy for my overall stock portfolio, and picking a stock or ETF that is more tied to the paper price of gold and silver rather than the physical metal itself eliminates this hedging effect. I am a big fan of Sprott’s PHYS and PSLV over GLD and SLV. There are plenty of other alternatives. The plus of investing in gold and silver stocks over bullion is a reduction in tax burden and liquidity problems should you decide to sell your holdings.

For riskier plays, I like to buy stocks in the mining industries, as well as royalty companies. There are many options to choose from. When deciding on what stocks to buy, pay attention to geopolitical risks in the mining areas as well as all in sustaining costs of the individual mines.

Carbon

Russia and Ukraine have shocked the global energy markets. In the short term, this will most likely lead to nations doing all in their power to keep their citizens lights on. Dirtier energy will need to foot the bill, leading to more emissions. However, I do not think this changes the long term goal of humanity to achieve net zero emissions, and this temporary setback will lead to some wonderful entry points into the carbon market. The carbon market is a complex beast to understand, and Marin Katusa’s free articles on his site katusaresearch.com are a wealth of knowledge. Look past the annoying popup ads and read some mind blowing content.

To me, it seems as though global climate change, whether human caused or natural, is a threat to humanity. Curbing this is a priority of most nations, and the carbon market is the grease to the wheels of the industrial machine moving towards net zero emissions. Emission standards are upheld through government regulations (via cap and trade standards) or though companies voluntarily going net zero (via the voluntary carbon market). The carbon market is a very simple example of supply and demand. There aren’t very few carbon credits in comparison to current and future demand for these assets.

You can buy an ETF that tracks the price of carbon credits. You can buy carbon credits outright in the cryptosphere. For instance, CoinBase offers the Moss Carbon Credit token and Klima Dao allows you to stake carbon credits. You can do some research and invest in companies that seek to develop a carbon exchange or even carbon tracking. Seeing as how there will be a demand in carbon credits, you can really dive into the weeds and find companies whose sole business model revolves around generating carbon credits to be sold on the open market. This market is still very new and will likely be the subject of future posts. To find out more, check out Katusa’s website and books. He is quite frankly very ahead of his time on this commodity and will be a key leader in the future development of the carbon market.

A Better View

The world of investing can feel a lot like stumbling in the smoke. After looking at my 401k account, heavy with tech stocks and large cap industry, and seeing the negative returns this year, I have been forced to reevaluate where I want to grow my wealth for maximum returns. A thorough understanding of commodities over the next few years will in my opinion be crucial if we should face a bad recession. To find out more, I can’t recommend reading:

- Hot Commodities: How Anyone Can Invest Profitably in the World’s Best Market by Jim Rogers

- The Rise Of America by Marin Katusa

Twitter:

These are a few of my favorite go to’s of the commodity world. There are a ton more out there. As always, it is important to get a variety of perspectives. If you are primarily focused with investing in tech stocks via your Robinhood app, these resources are still very important and can save you lots in investment losses. Many of the leading tech companies are paying attention to commodity markets and adjusting their business models accordingly. Some more than others. Now more than ever, it’s important to pay attention to the commodities markets should you wish to continue the investment strategy that has been profitable for the last decade. Should you see darker clouds on the horizon, like I do, perhaps pay even more attention and see opportunity in the commodity markets as we face an overall global economic downturn. As always, be safe and happy investing.

-Thefirefightereconomist

One thought on “Stumbling In The Smoke”