Deflation, unlike it’s counterpart inflation, is a fairly misunderstood force when it comes to understanding the economy. The textbook definition of deflation is simply a general decline in the price of goods and services. This decline is attributed to monetary policy by central banks, such as The Federal Reserve. If left unchecked, it can damage an economy and often gets a bad rap. However, in some cases, deflation is an incredible indicator of technological progress. San Diego’s EMS system is embracing a deflationary force caused by technological progress: The LUCAS chest compression system. I’d like to highlight our standard cardiac arrest call as a medium to explain how deflationary forces can be good, and then take a closer look at how deflation can cripple an economy.

Cardiac arrest calls can be some of the most straightforward calls you run as an EMS provider depending on your crews training and the scene you are working in. They follow a pretty cut and dry format. Typically in San Diego City, we have six people respond on a CPR call, two from the ambulance and four from the first responder fire unit. After establishing that our patient does not have a pulse, we begin a dance of sorts to give that patient every chance of survival. Usually the non medic firefighter gets started on chest compressions, and the paramedic looks for IV or IO access to begin delivering life saving medications. The engineer begins running extreme logistics, opening our gear bags, getting the patient hooked up to the cardiac monitor and working on establishing a patent airway so we can breath for our patient. As a captain, I try to get a good idea of what happened from bystanders and do my best to control the scene so that our crews can do what they do best, all the while documenting the actions of every member on our crew in real time. The ambulance fills in to assist with ventilating the patient and providing chest compressions. It is a lot of work, but with clear defined roles, it is a call that we could do in our sleep. By far the most strenuous work is done by our EMTs who provide the chest compressions.

The EMTs do the brunt of the manual work, swapping out chest compressors every two minutes throughout the course of on scene CPR. It is tough work that can last upwards of an hour at times, depending on where we are in the city. They bear this responsibility, because we need to free the paramedics up to maintain an adequate airway for our patient and deliver the life saving medications. Sometimes the engineers will switch in as well, which functionally ties up half of our workforce solely devoted to pumping oxygenated blood through our otherwise dead patients. It’s nothing like you see in the movies where 15 seconds of compressions leads to a miraculous save. It’s a marathon of hard work that leaves pools of sweat amongst the wreckage of used equipment and chaos of trying to bring someone back from the dead. While the dance of a CPR itself is straightforward, the dance hall can be a nightmare and I have wished many a times we had more people to help. Broken elevators with a patient on the sixth floor left me doing the best I could on chest compressions as the rest of the crew carried the patient down the stairs. We have been threatened by bystanders taking valuable personnel out of the equation to keep us safe. We have had to pull patients out of windows because they chose to live the hoarder life and left us no other means for extrication. We have done CPR hundreds of feet off a roadside in a ditch next to twisted wreckage of what was once a car and continued to do CPR as we stumble upwards back to the roadway. We get presented with a ton of curve balls that make patient care incredibly challenging. Ironically, if this patient does make it to the hospital, we hand them off to a team of doctors and nurses that can be twice our size in a sterile ER room. Quite frankly, on a CPR call, we are often shorthanded, but we still get the job done as best we can. We could always do better: enter the LUCAS chest compression system.

During our recent transition of ambulance services in the city, one of the many changes was a new piece of equipment, the LUCAS chest compression system. Looking like a toilet plunger strapped to a futuristic harness assemble, it sets up in less than 30 seconds. With a few pushes of some simple buttons, the LUCAS gauges the effective depth of compressions needed for effective CPR, and then sets to work via a long lasting battery powered ram. I was skeptical of the effectiveness at first, but recently I got to see it in action on a real life call. Without going into too much detail, it was a messy call. We had a difficult extrication, through a cluttered house. I needed everyone available to help figure out how to get the patient out and the LUCAS truly saved the day. Those two or three EMT’s normally devoted to chest compressions were able to work out the enormous task of how were going to be able to extricate the patient. We were able to work the problem, and eliminate all unnecessary time off the chest. This was one example, but the economist in me sees the deflationary force of this technology. It is literally freeing up half of our workforce on a CPR call to focus on better outcomes for our patients. It’s allowing us to be more effective. Its allowing us to solve problems around the CPR itself better. It is hard to quantify at this point how much of a difference this will make towards patient survive-ability as every call is different, but I can guarantee you it is making a difference. This is a deflationary force working for the good.

How Is Deflation Bad?

Remember, deflation is a general decrease in the prices of goods and services in the economy. If it is due to a technological advancement that frees up the workforce to do other good in our economy, this is good. If it’s caused by a monetary supply policy, this can be disastrous. You might be thinking, especially if you haven’t gotten a pay raise, doesn’t deflation sound great? The cost of groceries, gas, and other day to day expenses goes down. How could this be bad? Debt is the reason here.

Our economy runs on debt. In our own personal spending, we use debt to finance housing, vehicles, etc. If you want an easy way to hedge against inflation, refinance your house to a 30 year mortgage. Prices of everything else rises, yet your home payment remains the same. As time goes on, relative to your other spending your mortgage payment doesn’t seem like much. Deflation is the opposite price movement.

Say you borrow $500,000 to buy a house today on a 30 year mortgage and deflation kicks in. The amount you spend on housing stays fixed, while everything else goes down in price. As a proportion of your total spending, you will be devoting more and more of your money to housing. In a deflationary environment, your home value will most likely go down too leaving you zero equity in you home. For those of you that use home equity lines of credit, your days are numbered. What about your 401(k)? Well, many of the companies you invest in rely of financing to operate effectively. The debt these companies owe remain fixed, yet the prices they can get for the goods and services they create drops. Deflation can cause a downward spiral of credit line defaults that can crash economies that borrow a lot of money. They can cripple entire nations.

The US spends more money than it takes in in tax revenue. This is know as a deficit. They issue bonds to finance the deficit and ultimately pay back the borrowed money at maturation. By the Federal Reserve maintaining inflation at a higher rate than the bond yield, the government can pay back the money at a cheaper rate, because the purchasing power of that dollar is eroded by inflation. For instance if a bond yields 4% annually, yet inflation is 10%, the government essentially stiffed you on 6% of real purchasing power. If deflation sets in to say -10%, and you were holding that same 4% bond, at that bond’s maturation date, you would be up 6% in real purchasing power. Deflation for anyone or any entity relying on debt is a five finger death punch if it isn’t managed carefully.

How To Protect Against Deflation?

In the tug of war between deflationary and inflationary forces, it can be confusing to know what would be a good hedge against deflation. The easiest way for us firefighters to hedge against both inflation and deflation is to treat our wage as a guiding factor for our expenses. If your fixed expenses such as a mortgage, car payments, etc. stay within your budget, minor deflation will not be a huge concern. However, if you use debt that maxes out your base wage to finance your lifestyle, you could be in a world of hurt, even at minor inflation rates. In the current economy, holding cash in a bank is eroding your purchasing power due to low interest yields and inflation. In deflation, it would make more sense to hold onto a lot more cash while really looking at what you want to purchase in terms of investments. So what do you invest in during deflation?

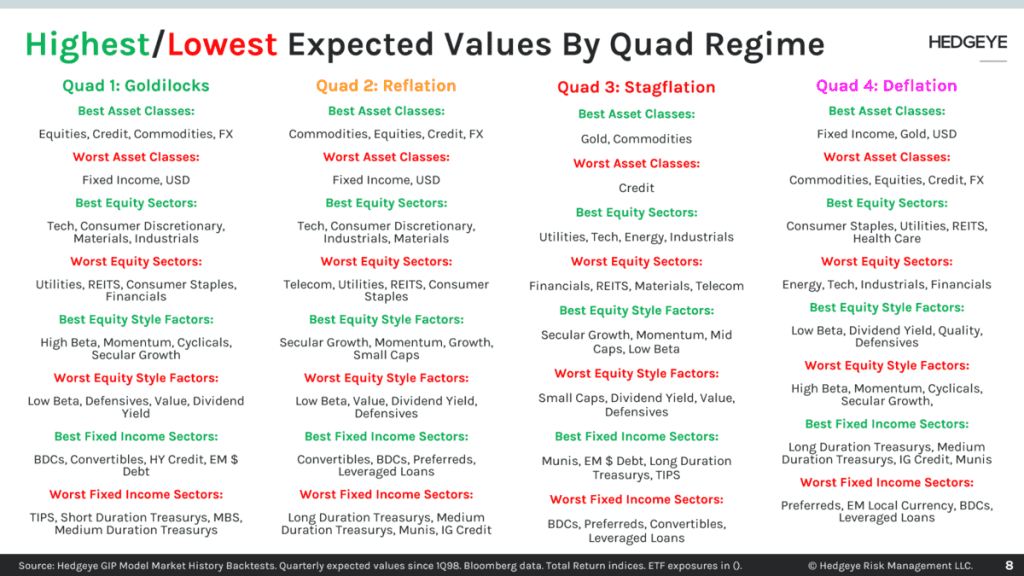

HedgeEye.com is a popular website that seeks to answer such questions of what to invest in in periods of deflation. They use a unique model to clump the economy into four separate quadrants. The subscription to this service runs about $30 a month for the basic platform and features daily calls and recommendations on what stocks and funds to buy into based on overlying macroeconomic factors. I find it has helped my trading immensely, but should you not wish to pay a full subscription, they have plenty of great free resources on their site and Twitter accounts. By far one of the most valuable references I use on a daily basis, is their Quad Chart. According to HedgeEye, we are gearing up and are in the process of rotating into Quad 4, or Deflation. Want the simplest answer on how to protect for deflation, and don’t want to take any sort of jump into any markets, you can see, holding on to cash is one of the easiest ways to hedge against deflation. Perhaps think twice on your favorite tech stocks and beef up on your higher dividend paying stocks if their Quad 4 theory plays out.

In Summary

Deflationary forces can be incredibly beneficial to society if it is a result of better technology. The technology frees up the workforce to accomplish bigger and better things. We are experiencing the powerful force of deflation on every CPR call we run when LUCAS free’s up half our workforce to better serve the needs of a cardiac arrest scene. However, if deflation is a result of monetary policy contraction, you need to pivot your investing strategy or you can pay a huge price in your long term investing goals. As always, this information is purely meant to inform. I wish you all the best in your investing strategy and your financial goals.