Generational wealth for most people does not happen overnight. It is a long and slow process borne of tedious and deliberate action over the course of years. This is the first year that the Firefighter Economist Blog is up and running and instead of a New Year’s post boasting success, I would like to post a thought on time horizons in investments and growth. This intentional journey towards financial freedom started only a year ago. I am not rich by any means, but I am no poorer than before last year. It would be a lie to say I’m not a little disappointed in my balance sheets. Instead, a healthy respect for time horizons and the value of this years education is in order.

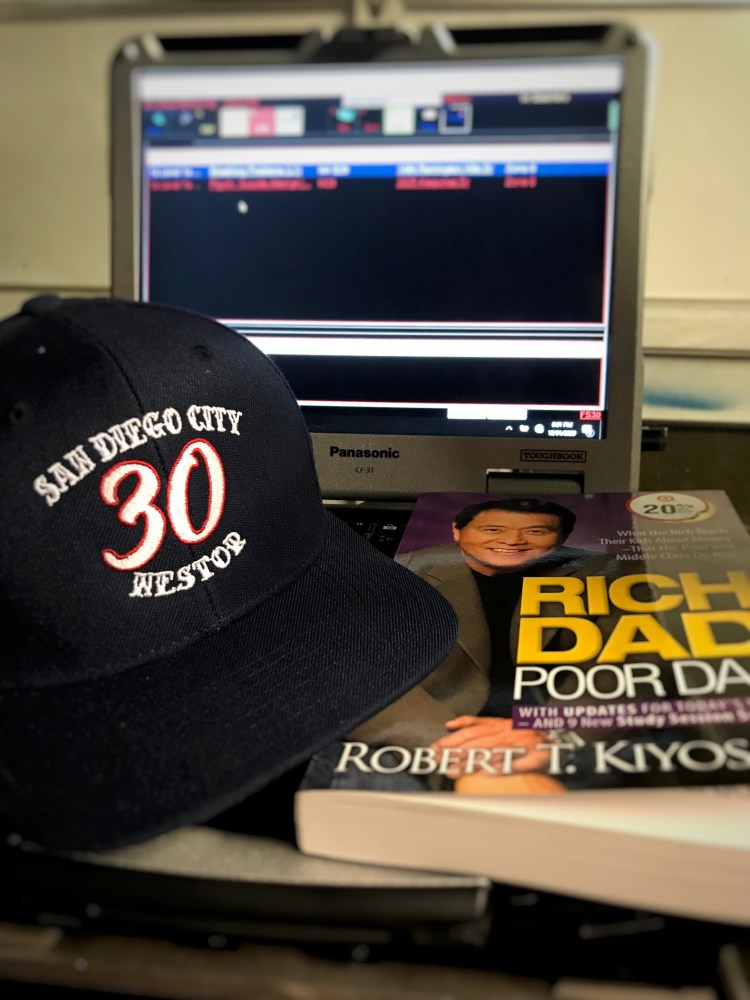

It was on New Years Eve that I read Robert Kiyosaki’s Rich Dad Poor Dad cover to cover during a relativity uneventful shift in San Diego’s South Bay station 30. Despite a degree in economics from UC Davis, I realized how functionally illiterate I was when it came to personal finance. If you were to look for a book to illuminate the lies of the traditional financial institutions, and the sub optimal practices they preach, look no further than Rich Dad Poor Dad. It started me on a path towards investing, learning, failing and succeeding. This year has been an incredible year of introspection.

Reading that book, and books like it takes you down a path that isn’t for the feint of heart. You learn quickly that the traditional financial institutions are hanging on by a thread. The sterile “safety” of the major banks are propped up on a “Too Big To Fail” paradigm that when broken will leave banks in tact, but the every day blue collar middle class worker in financial ruin. This year was an education in how to protect myself from such perils. In the process, I heard plenty of grumbles from my fellow firefighters about their own financial freedoms and ability to provide for their families. And thus this blog was born as a small contribution to my fellow brothers and sisters riding on Big Red. This is not a get rich quick endeavor, and the things I have tried to highlight this year have been key ideas to understand how to build wealth and what we are up against in doing so. Time horizon is everything in this.

Time horizon is the amount of time you expect your investments to come to fruition and deliver the results you are looking for. If you aren’t certain of how long you wish to tie up your money into an investment, you probably have no business being in the investment in the first place. Want to double your money, but have no realistic time horizon for doing so? How will you be successful? How can you measure success? Bring up a compound interest calculator and mess around with time frames for your 401(k). See the difference in 10 vs 20 years. Time allows money to grow. Keeping a longer time horizon on investments you truly believe in will allow you to keep a cool head in a year like 2021, when the S&P500 posted a nearly 27% yearly return rate and your investment thesis yields half of this. Having a clear time horizon allows you to comfortably part ways with a small chunk of money to invest in that startup company. Knowing that it may be 7, 8 maybe even 9 years until you see any return on the investment.

I see this year of learning and movement towards financial freedom as a respect for time horizon. This was the first year of an intentional journey. It would have been irresponsible for me to think I could welcome 2022 as a rich man. Instead, I see this as a breakeven/slightly ahead year packed with plenty of great lessons learned. Moving into 2022, my focus will be to focus on taking emotion out of investing, letting my winners ride, and cutting any loosing investments early. With such discipline, I believe I can shorten my time horizon towards financial freedom. Lofty goals are met by taking smaller chunks of the objective at a time. So in the effort to respect my time horizons to financial freedom, I have made the following goals for 2022:

- I would like to continue my financial education by reading one economics/financial book a month.

- I want to improve my stocks and options trading strategies and beat the S&P500 index on a consistent basis in future years. This year I would like to have my portfolio growth match the S&P500 index’s return rate performance WHILE holding myself accountable to my own set of investing rules (cutting losses early and letting winners ride based on technical and fundamental analysis every investment).

- I would like to average one blog post every two weeks at a minimum. This is set to be a busy year, but I feel this is an achievable goal.

I hope all of you had a great 2021 and are doing everything to make 2022 a year of wealth, happiness and growth. I look forward to more learning and more progress as we work our way towards financial independence! Happy New Years everyone.

Excellent work Tanner! I saw you Dad and Annie at the beach, and they told me of this blog. I’m glad to have found this, thanks for your financial insights.

Sean

LikeLike

Thank you Sean! Hope you and the family are doing well.

LikeLike