This post is part rant, part reaffirmation. The world we live in is in a perpetual fight between the reigns of control and freedom. What is happening across the economy is no different than the struggles company officers face every day in the fire service. I think there are a lot of parallels that you can draw between the virtues of mission driven culture over command and control models of fire service command and free market capitalism vs. more centralized economic system. All of these are fraught with their pitfalls, which I would like to highlight, but at the end of the day, I stand firm in believing my crew should embrace mission driven culture over centralized command, and our economy should fully embrace free market capitalism over the tyranny of a centralized economy.

Decentralization In The Fire Service

We respond to a myriad of emergencies. Some are complex, warranting every brain on the scene to be working a full capacity to stabilize the impossible. Others are so benign, we could probably train a monkey to do our job for us. There is a spectrum here. As company officers, I firmly believe we need to empower our people to operate at the far end of the complexity spectrum with little supervision. This isn’t something to be taken lightly. We have a lot riding on the line. The safety of the public and the sanctity of their trust in us as first responders is on the line. A few years ago, our chief Brian Fennessey introduced our department to the concept of mission driven culture, or MDC for short. MDC is a framework in which we utilize the mission itself to guide our actions. Along the way we utilize existing policies and procedures as guideline to accomplish the task in a way that allows us to effectively work together, but it is on each and every firefighter to collectively work towards the mission. How does this work so well? It is incumbent upon us to train. We need to know how to communicate, and operate effectively using the best strategy and tactics for the job. Ultimately as officers, we need to TRUST our people, give them clear expectations, and send them to work unencumbered by OUR relentless oversight. It’s an incredibly hard thing to do, but if you train well, give good feedback, and demand only the best practices, your crews will thrive without you. Here is an example of SDFD’s Mission Driven Cultural framework.

Stumbling Into MDC

As a new officer, I was incredibly hesitant to switch towards this MDC. As a new officer, a lot goes on the line. There are a lot of eyes on you from above and below in the ranks. Amidst the pressure, there were some growing pains along the way. I found myself hovering on every call, no matter how small. I called out everything wrong with an incident. The results were terrible. Because I micromanaged everything, my crews gave up on being proactive. Every decision they looked to me for the answer. I didn’t realize how bad this was until we had a larger incident. In the grand scheme of things, it wasn’t even that complex. It was a simple house fire with some downed power lines and a occupant jumping out of a first floor window. We got there first and I got sucked into the individual tactics of each of my crew members. They were good firefighters and I blew it by micromanaging. All the energy spent in this made me forget my role as the incident commander. I spent so much effort worried about HOW the job was going to get done rather than WHAT needed to get accomplished. When I turned the scene over to the Battalion Chief, I realized fully that I hadn’t set up the incident to address some of the major safety issues that could get my crew hurt or killed. Who gives a damn what hose line was pulled if I didn’t see the downed power line at the rear of the structure or the victim jumping out the window on the side of the building? It took a very honest conversation from the BC and some very hard introspection to realize the errors in my way.

A Change In Tactics

After that fire, I did a lot of soul searching to realize a path towards decentralized command. It hasn’t been a smooth path, but its progress. The hardest thing I have had to learn is to let go of the nagging “what if’s” in my head when allowing my people to work without my direct supervision. We have great people in our ranks. I need to let them be great. This isn’t a free for all. I have to do a risk benefit analysis of every decision I make in delegating orders and determining the amount of oversight needed. If I have an inexperienced crew, I watch them closer. If the potential bad outcomes of the incident mount, I stay a bit closer. However, a vast majority of our emergencies can and should be handled at the firefighter rank. So how does this look for me progressing towards another fire? I saw our ringing alarms, or alarm system activation calls, as a perfect crutch to getting my crew where they should be for a real fire. Typically 99.9% of our ringing alarms calls are due to some malfunction of the system. We respond, investigate for hazards, and reset the alarm system. Easy. In an effort for my own personal growth and the growth of my crew, I made a pledge to not get off the rig for these calls. Or, in a more complex system I at least delay my departure from my seat by a few minutes. I gave clear expectations to my crew that I want them to investigate, report on conditions via radio, and attempt to reset the system. Now, they go inside without me, handle business, communicate effectively, and restore an alarm system without my supervision. They interact with the public in a respectful manner expected of the public servants that we are. It builds muscle memory for them. They are more comfortable reporting on conditions, something we desperately need on scene of a more complex incident. It allows me to be freed up to focus on any larger strategic decisions if they need to be made. Most importantly, it is a small gesture to my crew that I trust them to handle things. I am damn proud of how my guys have taken this in stride. They are great firefighters and I need to let them be great at what they do. This is just one small example of how I do my best to commit to a culture of decentralized command.

Non Perfection To Betterment

This system has its share of pitfalls. As firefighters, we are in the business of fixing mistakes, and in the process, we are bound to make mistakes. If you let the reigns go too far on an inexperienced crew, or you yourself get in above your head without calling for adequate resources, you are going to run into trouble. The key is to weigh out what constitutes an acceptable mistake, evaluated how YOU as the company officer can ensure it doesn’t happen again. You need to communicate with clear expectations and remediation how your crew can do it better next time. You need to work with your team to do things better, both in training and on real incidents. Problems change, and it takes every mind in a resilient system to fix the issue. This usually starts in the form of an after action review, or AAR. Crews and peers gather around to discuss communications, tactics, strategies, etc. They talk about what worked and what didn’t. I am not afraid to ever tell my peers, supervisors, and crew how F*$cked up I was on an AAR. It’s cathartic and productive. It leads to every one doing better. If we build a culture of honesty and devotion to progress, we can’t go wrong. Mistakes will be made, but you will be damn sure we will learn from them. Incidents can be incredibly complex, and there is no one right way to handle any emergency and countless ways to do it wrong. The key is to share perspectives, actions, thoughts, and to come together as a company, department, or even a fire service for that matter to shape the overall mission priorities for every emergency type. I am incredibly proud to have been and be on crews that share their mistakes with candid honesty for the sake of progress. We grow from it. We learn. Alternatively, our command staff could write a new encompassing policy to bind our actions to discipline for future incident types. In some cases, this is warranted, but in others this absolutely destroys organic progress of the fire service. Free market capitalism is no different.

Free Market Capitalism

Recall from the article on Supply and Demand that price is the ultimate communicator to suppliers and consumers. In a free market capitalism system, price is king. Any intervention from an outside source, such as government or corporate collusion, to the way price moves up and down those curves will lead to either suppliers or consumers paying a price. If I were a wheat farmer, in a free market capitalism system, the price I would get at the grocery store would be determined by the supply of wheat being offered by my farm and also my competitors met with the demand of the people buying them in stores. If I grew too much, supply would swell and given a fixed demand, the price I would get per bushel would shrink down. Maybe I couldn’t cover my cost and I would go out of business in the wheat industry. Maybe I could survive another year and HOPE demand will rise or supply from other suppliers will shrink in comparison to my acreage. As a still very junior company officer, I have realized that hope is a shit tactic. Free market capitalism is very much a Darwinist system in which only the strongest survive. I have a few options as that farmer. I could roll over and live a life of destitution, I could move to a new industry where my wheat farming skills could translate to, OR much like firefighters in Mission Driven Culture, I could figure out a way to more efficiently perfect my craft. In free market capitalism, when faced with adversity, suppliers are incentivized to innovate in order to stay relevant. Efficiency and productivity prevails. Society benefits, and I reap the rewards of my endeavors. Of course this is oversimplifying a very complex system we call our economy.

Centralization Is Not The Answer Most Of The Time

This is a blanket statement fraught with many “what about” statements. The healthcare industry is prime example of this. The volatile fluctuations prices caused by supply and demand have no business causing undue stress to anyone in need of a reliable amount of live saving medications at a predictable cost, and therefore I think most people would agree that some amount of price controls by government would be acceptable. But what if other price controls that incentivize poor life choices, leading to a reliance to such medication were removed? What would our flailing healthcare system look like if the true cost of refined grains and factory farm produced meat were allowed to wander along the supply and demand equilibrium rather than being propped up by government subsidies? What if the true costs, stripped of any government interventions, were revealed. I could guarantee you that a salad at your favorite fast food joint would be astronomically cheaper than the burger, fires and coke combo. Would this lead to a decrease in diabetes, obesity, cancer and a myriad of other health problems that make us dependent on large pharmaceutical companies for the cures to live longer? No one knows for certain, but looking at probabilities, I would venture to say yes.

There are other arguments pro centralization worth mentioning. In the midst of mobilization for WWII, our economy switched to full centralization. Our rural lands were stripped of able bodied men and women to fight the wars in Europe and Asia. Strict price controls and other restrictions from Washington ensured our entire nation’s focus was geared towards success. Free market capitalism was abandoned in the name of self preservation against Nazi Germany and Imperial Japan. It worked to boost our economy to full operating capacity. It worked because there was a single mission that the entire country was united behind. The boost in productivity also worked because we had little debt.

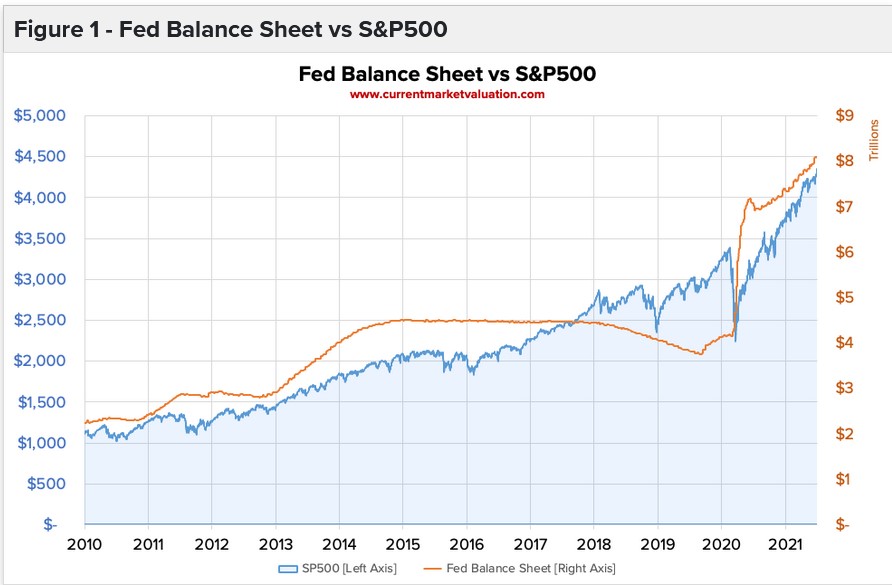

Debt and productivity matter. Governments spend money and collect taxes to offset spending. If the government spends more than it takes in, it runs a deficit. Government debt is not necessarily a bad thing if productivity remains high. Productivity of a nation is measured by GDP, or Gross Domestic Product. Armed with these two numbers, a debt to GDP ratio can be formed. It is simply debt divided by GDP. How much you spend divided by how much productivity you have to show for it. Healthy economies will typically have a GDP ratio of under 77%. Anything over for longer periods of time have historically lead to a slower economic growth. When the USA entered WWII, the debt to GDP ratio was about 44%. It ramped up to 114% by the end of the war in 1945. We spent a lot of money to fight our fight. As a result, the five years after, we experienced a small recession until the start of the Korean War. Fast forward to our last decade since the Great Financial Crisis, and we have grown our debt to GDP ratio from 90% in 2010 to 122% in 2021. What is this telling us? Quite frankly government is spending more money and getting less increase in productivity. We are printing money to prop up a fragile economy. Many economist in favor of less government spending would call this increase in spending “monetary heroine.” Much like a heroine addict needing more and more product to achieve the same high, it take more and more spending each increase in government spending to get an increase in GDP. When comparing a graph of the S&P 500 with the Federal Reserve’s balance sheet, there is a stark picture to be painted. Most of the wealth created in your 401k and other retirement accounts linked to the stock market are purely a result of government spending and new money creation. Don’t get me wrong, I am a huge advocate of stock market investing, but proper risk management and the ability to have one foot out the door is a necessity in this market insanity.

Another useful metric is the Buffett Indicator, which measures the total value of the stock market in relation to GDP growth. Essentially it shows how much we value the companies that contribute to the actual growth of the economy. This has historically followed around a centralized trend line, but is currently 66% over the average indicator. For historic context, at the peak of the dot.com bubble of the 1990’s the Buffett Indicator peaked at 68% above the trend line. History may not repeat, but it does rhyme. Are we headed for a market down turn? The probability of such an outcome is heavily weighed towards yes.

Moving Forward

So where do we go from here? As an economy, we have become so dependent on a financialized system to sustain moderate GDP growth. Government spending has propped up private industries at an increasing rate over the last 10 years. We have gotten away with this because the world runs on dollars. Through masterful foreign policy at the end of WWII, the US leveraged it’s status as a a major gold holder to ensure this. Later, when negotiating oil deals, the petrodollar was born to perpetuate a dollar dominated economy. Eventually the dollar being king may not be the case. Some day should the other superpowers of the world decide to incentivize our allies to switch to a different currency standard, perhaps the Yuan or Ruble, and the Dollar looses its relevancy on the international stage, what will we have to fall back on? It will be our productivity, and quite sadly there is nothing substantial to show for this compared to Russia and China. Perhaps its time to start promoting free market capitalism.

The growing pains will be tough. We have been coddled for over a decade by cheap money borrowing. Big corporations that are feeding millions of mouths and operating at sub optimal efficiency will need to be put to the fire to sink or swim. Additionally, the amount of people reliant on government programs and spending (spending that includes the budget of most fire departments) has also increased exponentially since COVID 19 lock downs, and they too would feel the crunch. As a nation, we are in a precarious position. To switch towards free market capitalism will cause some speed bumps and hardship. It’s just like the growing pains associate with our Mission Driven Culture. This doesn’t need to happen overnight, but perhaps some small measures of hardship in a controlled descent towards a more manageable debt to GDP ratio is what we need to create a more resilient and robust economy that can withstand centuries more of being a key player in the world economy. From these small hardships, we can see true progress and growth. Just like every productive AAR in the fire service, the economy can learn, grow and be more resilient without the need for an over reliance of a central government. It is virtually impossible to know how every man, woman and child in our country needs to spend their money, yet our politicians on both sides of the political spectrum continually push for more government oversight to govern how we make our money and how we spend it. There is not sustainable, nor is it leading to a resilient economy.

As individual investors, we can take steps to protect ourselves from the challenges to come. The stock market and cryptocurrencies are incredible wealth building tools, but if the individual companies, projects, ecosystems, or whatever you want to call them are merely sustaining their value by easy money printing from the Federal Reserve and subsequent government spending, some hazard assessments need to be made. Having reserves of cash to buy assets on the cheap is a must. Selling enough shares to cover initial investments in companies you have invested in is a simple way to de risk your portfolio and keep your hat in the ring. Exploring investments in foreign markets tied to countries with better Debt to GDP ratios can hedge the risk of a dollar devaluation. For instance, if you invest in a Russian natural gas company and they pay dividends in Rubles, if the dollar to Ruble exchange rate changes in favor of the Ruble, your dividend payment in dollars will be better at the time of conversion. Perhaps explore the concept of building portfolios in companies that provide real value to the economy, or are an essential service. For instance, through a market crash, everyone will still need their lights on and their homes a comfortable temperature. The right cash flowing real estate holdings can at least protect your purchasing power through inflation and deflation if done correctly. There are countless options.

For the time being, my plan is to take advantage of a “booming on paper” economy to build wealth. However, I will always take steps to de risk and keep a close eye on this proverbial house of cards collapsing so that I am not wiped out by a over a decade of irresponsible money printing and big government. I can only hope the government and the Fed see’s this error in it’s ways and begins taking steps towards decentralization. It is doubtful this will happen. Why would you give up power if you yourself are not experiencing the hardships caused by your decisions? It’s time to position yourself to be safe from what could come. Does it have to be the sole focus of your investment strategy? Absolutely not. Most importantly, now more than ever, its time to pay attention and see the bed we have made through excess money printing and an ever increasing centralized government.

Links