There are a lot of firefighters and first responders out there feeling the crunch of inflation. I’m one of them. I realized the writing on the wall late last year as I struggled to pay the bills and shop for Christmas presents for my family. Without a sizeable raise, I reckoned inflation would outpace my families ability to continue the lifestyle we liked to live without needing to work more or cut back. We already live a pretty frugal lifestyle and quite frankly, as much as I love my job, I love being with my family more. Looking at options for growing my dwindling bank accounts, I settled on starting to further my education in stock market investing. Stock market investing has a number of perks over other forms of investing and it was the right fit for my budget. Getting in and out of a stock position is easy to do, unlike real estate investing or other long term prospects. It requires very little up front money, and the options for investing are seemingly infinite. It is risky. It can cause you to loose more money than you started with if you aren’t careful, but if you take the time to do it right, you can build a robust portfolio of assets to grow your wealth and buy yourself more time to do the things you love. I thought I would go over some considerations for how to invest in the stock market.

#1: Realize Investment Money Is Just A Tool To Build Wealth

I put this at #1 because this is my Achilles heel. I constantly look online, read books, and listen to podcasts on the latest investment opportunities. I have to remind myself that I only have a limited amount of cash or capital to invest, and that I can’t invest in everything. You don’t have to buy into every hot stock pick you get from your buddies at the station breakfast table. Chances are, you will get burned trying to jump into every investment opportunity. I have made this mistake a lot in my stock market investing. It is therefore incredibly important to realize that investment money is merely a tool to build wealth. As firefighters, we solve so many problems, from critical medical emergencies to complex vehicle extrication. Every problem requires a mental checklist to determine what the appropriate tool is for the task at hand. You wouldn’t use a sledge hammer to perform life saving chest compressions on a CPR call, so why would you risk a ton of money on an investment you don’t understand? Some stocks will grow fast and lead to an increase in price that you can capitalize on via capital gains. These are called growth stocks. Others stocks give a stead dividend payment but appreciate more slow for passive income. These are called income stocks. Really take the time to see what your investment goals prior to jumping into the stock market. Ask yourself, Do you want to grow your portfolio fast or do you want to preserve wealth over time? Every stock is a different tool to get you where you need to go financially, but you really need to ask yourself what your investment goals are and then pick the right tool for the job.

#2: Research Prior To Buying

Investing in a company should be a well thought out process. It should be like bidding into a station. Unless your are a newly off probation firefighter looking to hang their gear at any firehouse that will have them, most firefighters weigh the decision of a station move very carefully. The look at the district. After all, you are spending a great deal of time there. Do you like the place you will be working in? You look at the crew. Are their bad apples that you won’t mesh with? Do they like to train? Do they have a good reputation? Will they drag you into trouble or help make you the best firefighter you are capable of being? Investing is no different. Will this company perform and take care of your hard earned cash or send you on a wild rollercoaster ride up and down? Spend the time to learn fundamental analysis of any particular company. TD Ameritrade has some phenomenal online learning programs that break down stock analysis. The courses there are free and worth every second of time spent. Twitter, Seeking Alpha, Yahoo Finance, and a host of other online sites contain an infinite amount of analysis that can best provide you with everything you need to know about the stock you are interested in. If on further reflection, you realize that amount of work isn’t for you, consider investing in a broad based index funds or sector ETFs that encompass a lot of different stocks. This would be akin to the Probie happy to just be a member of their fire department. There is no shame in realizing that stock market investing in any particular stock isn’t for you, but in order to preserve your wealth, investing needs to happen.

#3 Choose A Platform And Account Type

There are many different investing platforms that allow you to buy stocks. All of them have basic fee structures and interfaces that you can use to invest in the market. I would highly encourage you to do your own research as to what platform you wish to use. I really like to use TD Ameritrade’s stock platform. I have gotten a lot out of their free education and their ThinkOrSwim platform syncs well with my phone and tablet. This is just my personal preference. Again, do your own research. Once you have decided on a platform, it is time to pick an account type. This has everything to do with taxes. I have two accounts with TD Ameritrade, one is a standard brokerage account. Earnings are taxed. If you want to do more aggressive trading and don’t plan on holding stocks for more than a year, I would highly recommend setting up a ROTH IRA trading account if you and your family meet the income requirements for such an account. In a ROTH IRA account, you put post tax money into the account, but your gains from trading are not subject to capital gains tax. The downside is you cannot withdraw that money until retirement, hence why I have a standard brokerage account AND a ROTH IRA account to do my trading. You can however withdraw your original contributions. One account builds wealth over time with a tax benefit and the other account allows me to build wealth and withdraw the funds sooner than retirement.

#4 Develop Your Rules For Portfolio Sizing

The collection of your assets (stock, bonds, real estate, etc.) is known as your portfolio. In order to properly reduce risk, you need to come up with rules with how you manage your portfolio. I have a personal rule of not holding any more than 10% in a stock that I really believe in and no more than 5% of a stock I am not 100% sure on, but have developed a compelling thesis to invest in. How does that look with a $1,000 account? Well, I’m sorry to have to break it to you, but the maximum size of any stock holding in any one company can’t exceed $100. This is a drag because most stocks trade over $100 a share. Remember, your money is a tool to bring you wealth and there are countless opportunities to build it. Don’t fall for that one stock that one share will take the full balance of your portfolio. If it drops 10% in a day, your whole account drops 10%. If you stay disciplined in your approach and instead only invested 10% into any one position, that 10% drop would only translate into a 1% drop in your total portfolio (10% of 10%=1%). By staying discipline in this manner, you can better hedge your risk of destroying your wealth in one bad market day. In addition, I always buy my stock positions in chunks over time. Instead of entering a whole position in a company in one go, I try to buy in four separate lots. In this example, that would translate into $25 increments. By spreading out your buying over time, you can expect to smooth out the risk of the stock going up and down over time. Develop your rules and stick to them. It’s hard to see a winning stock go up 30% in a day, wishing you had put more into it, but by staying disciplined, you will eliminate a lot of the downside risks with stock market investing.

#5: Understand What Makes A Stock Cheaper Than Others

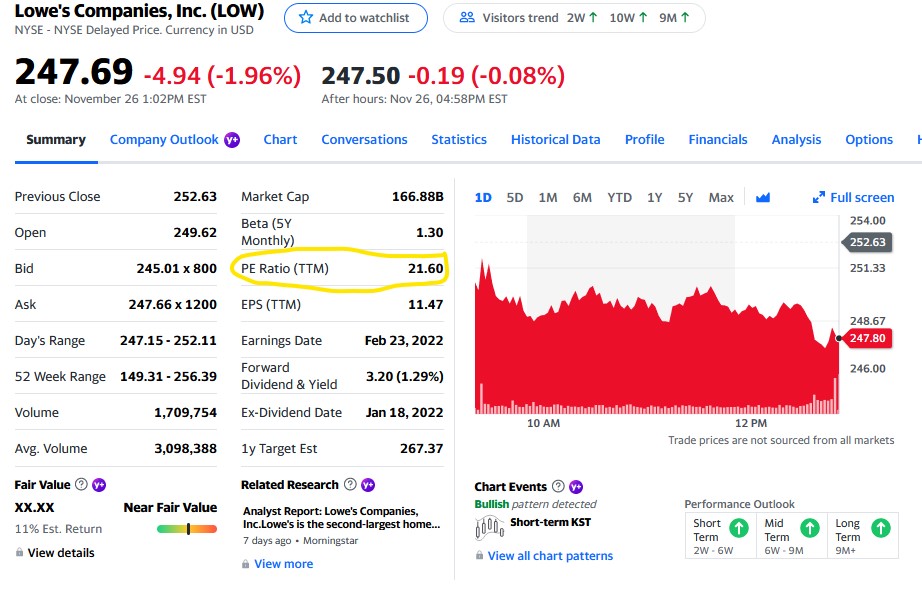

You will often hear people say what price they bough a stock at and that is fine, but only if they are talking in the right context. As firefighters, we value our experiences going to fires. They represent a accumulation of all we have trained and worked hard to achieve. Going to fires is still a source of pride. If I am out to breakfast with some of my academy mates and I tell them I have had 5 fires in the last month, it sounds great. If I tell them those 5 fires were part of a call volume of 500 calls that include a mix of traffic accidents, medical aids and other emergencies, it changes the perspective. Say another academy mate says he’s responded to 2 fires, but after doing a little digging, he states that their station has only had 100 calls total this month, he is getting 1 fire for every 50 emergencies and I am only responding to 1 fire for every 100 emergencies. If you value responding to fires, my friend is doing a heck of a lot better than myself. In stock investing, really take the time to learn fundamental analysis of the stock market. Again, get an account with TD Ameritrade and take advantage of some stellar free education. A simple fundamental analysis I use when looking at stocks is to use the P/E ratio. The P/E ratio is simply the stocks price divided by it’s earnings per share. It boils down to this, for every dollar I invest in a company a portion of that money will earn money. If a stock earns a lot compared to it’s price, its a better buy for me. Historically, stocks in various industries trade within a range of P/E ratios. If you are shopping around for stocks and comparing similar stocks, use the P/E ratio to determine which stock is actually cheaper. Ignore the price and look at P/E ratios in order to determine which is a better fit for your investing goals. Look at this example of Home Depot vs. Lowes. Home Depot is trading at 26.93 times earnings and Lowe’s is trading at 21.60 times earnings. In this moment in time, Lowes is both cheaper in price and in P/E ratio.

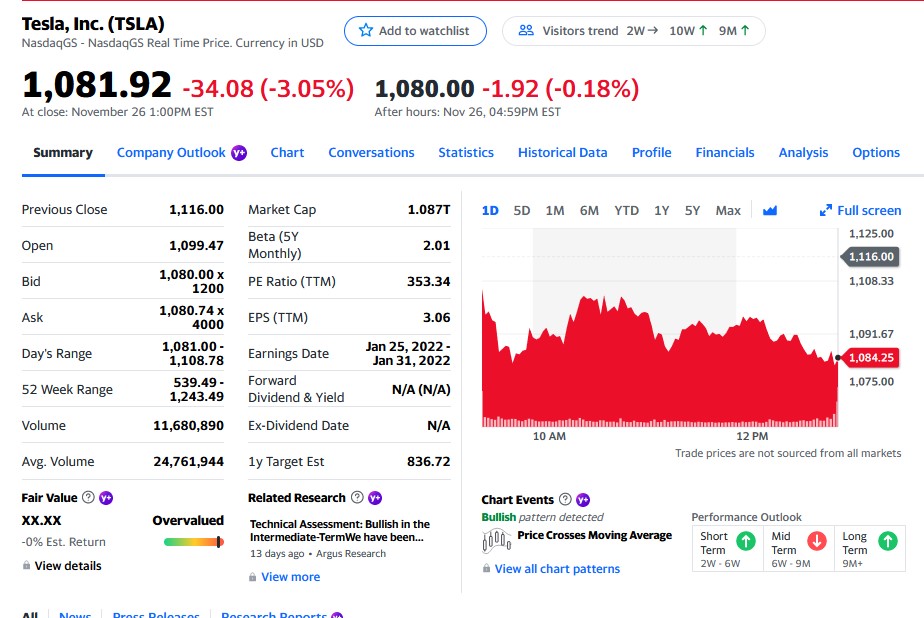

There is a lot more analysis to be done, but P/E ratio is a big factor in determining if I’m willing to invest in the company. It’s a good first step in starting to understand what makes a stock cheap vs. expensive. Earnings stay relatively stable over a quarter while the stock price jumps around with day to day news and stock market pressures. If you figure out what P/E ratios you want to buy that stock at, you can then buy the stock at the P/E ratio and not the price as a guide point. P/E’s should be used when comparing like companies in similar industries. Some P/E ratios are insanely high due to expected performance of a company vs. actual earnings. Take Tesla (TSLA) for example. At the same time of the Lowe’s and Home Depot comparison, Tesla is selling for 353.34 times earnings. It is in a different area sector of the economy, that typically has higher P/E ratios for stocks. Some stocks, when they are just building or have had a rough quarter will have zero or even negative earnings and won’t even have a P/E ratio. Again, P/E isn’t the end all, but its a great start when comparing various companies in a given industry. The ultimate point is to use actual metrics to compare stocks or pick times you wish to buy rather than just jumping in blindly.

#6: Don’t Buy Your Stocks Right Now With A Market Order

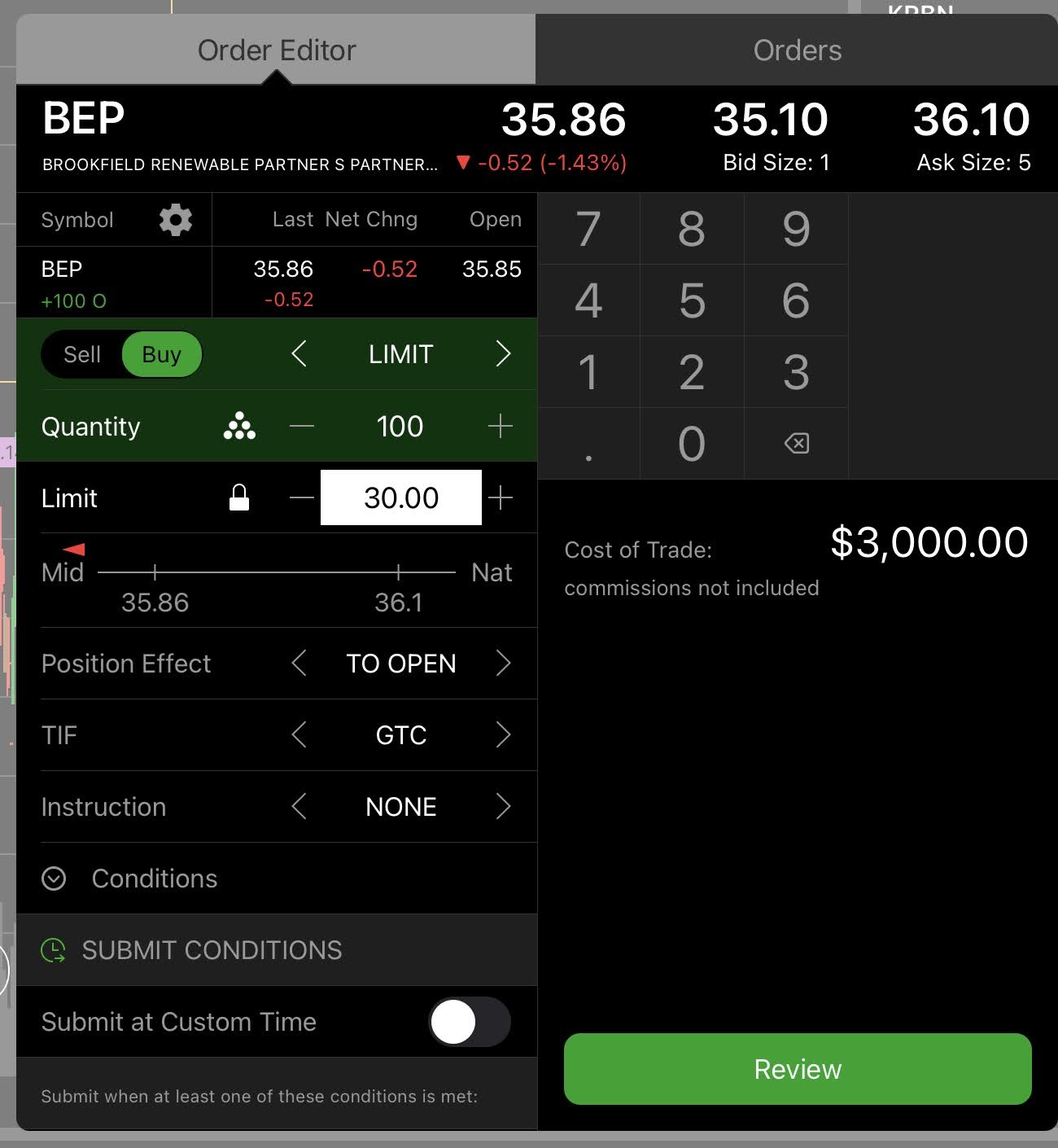

When you go to buy a stock, there are a number of ways to purchase a stock. You can buy via a Market order that guarantees you will get the stock, but does not guarantee that you will get the stock at the listed price. If you are buying, the price will often be higher than what you pay. If you are selling, you will usually get a lower price. If you want to buy the stock RIGHT NOW, put in a market order, buy just know that you will be getting a sub optimal price. If you buy and sell multiple times each day, the lost costs of Market Orders can add up big time over the course of a year. Instead of Market Orders, I like to use Limit Orders. You set the prices that you would be willing to buy and sell your stocks at. It’s a very controlled, set it and forget it approach for basic stock market investing that works well. If a stock is on my long term wish list, I set buy orders and then change the expiration for that order to be GTC (or Good Til Cancelled), which allows me to buy that stock anytime in the future for the price I am willing to pay. Yes, it can be frustrating to see a stock you want to buy skyrocket up and up and up, but again, realize that investments are just a tool to build wealth, and there are other tools to get you to where you need to go. Either keep the limit order in place, or look for other stock buying opportunities.

#7: Keep Some Dry Powder On Hand

Dry power in the investing world refers to cash on hand. Nothing is more frustrating than when the market dips and you don’t have any purchasing power left in your account. It takes a lot of discipline, but try to keep some extra cash on hand in your account to take advantage of such a buying opportunity. It’s hard to do. You want every dollar working for you, but you really need to do it. I try to keep at least 20% of my brokerage accounts free to trade. This doesn’t necessarily mean you have to keep it completely free. If you learn the basics of options trading, you can sell put options on stocks you want to own at the price you want to own them at. If the stocks never reach that price by the time the contract expires, you get to keep the contract premium. The resulting yield is way more than you would get in a savings account if you do things right. This is more of an advanced topic for another post, and if you don’t even want to touch the options strategies, just keep it simple and have some extra cash ready to buy some great stocks at a great bargain. Do this at the end of the year especially. As people sell their “underperforming” stocks for tax purposes, the collective selling pressure will drive these stocks down to areas you may wish to purchase them at. If you’ve done your homework and believe in the investment, you are getting an incredible deal served to you on a silver platter. It’s akin to shopping for a turkey on Black Friday with your crew.

These are just a few of the hard lessons I have learned in my few years of stock market investing. There are countless more intricate details and pitfalls that I have made. This year I have spent a lot of time into honing my skills in my investment accounts. I would like to go on record to say I’ve eked out a small profit, but by no means have beat the market. I take it as a win and the individual losses as the cost of a great trial by fire education. These accounts are only a small portion of my overall investments. The bulk of my investments are in the form of a set it and forget it 401(k) style target retirement date fund, which I think would be good for most investors. Should you wish to venture into the world of stock market investing, do yourself a favor and educate yourself first. Again, I can’t recommend TD Ameritrade’s platform enough. The education is top notch and the platform is incredibly intuitive. They even let you conduct paper trading to practice your investing with fake money so you can hone your techniques. I hope these pointers set you on your way to take control in building a portfolio that outperforms the market and gets you where you need to go. Happy investing.